March 22, 2015

This article is for people who have defaulted on their Sallie Mae/Navient student loans. If you haven’t defaulted, or if you’re paying traditional subsidized or unsubsidized federal loans, this won’t work for you. For those of you that ARE in this position, this post is for you. You can get your life back.

I’m sharing all of my actual numbers, because it makes the conversation more useful.

Managing the chaos

Like many people, I was unemployed in 2009-2010. I had the bad fortune of graduating in the middle of the recession, and had quite a bit of difficulty finding a “big kid” job, i.e. one that would let me pay my bills–including my student loans. Also like many people who are struggling with debt they can’t pay, I was plagued by phone calls, and they were universally unproductive, because stones don’t have much blood to give. The first step to getting your feet under you is to create mental space, and the biggest thing is to stop the unwanted calls.

In addition to sending letters, I did this:

- Get a Google Voice number

- Log into your delinquent accounts, and use the Google Voice number as your only phone number

- Don’t answer numbers you don’t recognize

- Take down each collection agency’s contact information (phone number, debt they’re collecting on, etc.) when they leave you a voicemail

- Block each caller one by one

This builds a strategic rolodex for tackling your debts when you’ve got your feet under you. If getting back on your feet takes a while–it took me 2 years–you’ll notice that debt gets resold fairly often, and as it gets resold, the settlement offers get better and better. This is particularly true for unsecured, consumer debt, and less true with student debt.

Negotiating with Sallie Mae/Navient and FMS

Sallie Mae stops trying to collect debts themselves fairly quickly, and they tend to outsource this to other agencies. Unlike consumer debt, Sallie Mae does not sell the debt to the servicing organization. Instead they retain ownership of the debt, as well as the terms and conditions under which that debt may be settled. (In fact, if you try to call Sallie Mae directly, you will be redirected to the servicing agency without ever having talked to a human being.) The debt collector is just a proxy, but they’re the ones you’ll be dealing with.

My debt was serviced by an organization called FMS. You can Google them; there are many horror stories, but my experience was pretty good, barring a few incidents. I had settled a couple of smaller credit card debts to this point, so I made sure to unblock their phone number only when I had a small lump of money available to make a down payment. I knew I wasn’t going to be able to discuss a full settlement, but maybe I could do something to move the needle in the right direction. This ended up being a good move, though the benefits weren’t obvious until much later.

Default settlements

I’m going to use the term “default settlement” below. I don’t know for sure, but I believe that Sallie Mae’s proxies are authorized to offer some percentage (65-70% or so) as a settlement amount, without phoning the Sallie Mae mothership. The reason I believe this is true, is because they would periodically offer me settlements on the spot which didn’t require them to phone home. This was in contrast to my counteroffers which required a ~24-48 hour turnaround time where they had to talk to someone with more authority.

The reduced-interest plan

June 2011 balance: $144,586.

I brought my account up to date on July 25, 2011 with a $1,493.38 payment, and set up a recurring payment every two weeks for $372.56. This was their “reduced interest plan”, where the interest rate dropped to 0.01%. There was no discussion of a settlement at this point that I can recall. If there had been, it would have been WAY more money than I had, so it didn’t matter.

I made bi-weekly payments from July 2011 to May 2012.

The first settlement offer: the first $80K

In May 2012, I got a phone call from FMS to re-up my recurring payments. (They can only schedule 12 at a time.) At this time, the rep I had been dealing with all along offered me a settlement that was still too large for me to take advantage of in one shot. I told her as much, and if I recall correctly, she conferred with her manager and the Sallie Mae mothership, and they made me a counter-offer: an $80,000 reduction if I:

- Made a $7000 down payment by the end of the month

- Paid $800/month for 45 months

- At the 0.01% interest rate

This dropped the loan term from 155 months to 45 months, a 9+ year reduction. BUT, if I broke the terms, the full balance came back at the original interest rate, minus whatever I’d paid. I went for it, because saving $80,000 and 9 years was too good to leave on the table.

- Settlement starting balance: $45,375

- Made the $7000 down-payment (with my dad’s help) in May 2012, which

- Reduced the amount left to pay to $36,375 (or so I thought, more on that below)

I set up a $400 recurring payment every 2 weeks, including months with 3 weeks to ensure I’d make the deadline with some headroom.

A bump in the road

Unfortunately, FMS wouldn’t send me paperwork stating the terms of the settlement, which (as I suspected) came back to bite me. I also hadn’t recorded our phone conversations, because until this point, there was no reason to think that I would need to.

December 2013 rolled around, and I received a phone call telling me that I was almost out of time, and that I owed like $45,442 by ~February 2014, which didn’t sound right. Unfortunately, I was dealing with a new representative, and she couldn’t decipher the notes of the previous representative. It was my notes against theirs… and when you’re in this position, the other party holds all the cards; you’re just along for the ride, hoping they don’t fuck anything up too badly. (That said, I’m very confident that my notes were more accurate. Not that it mattered then, and I can’t imagine it would have mattered in a courtroom.)

There was about a week of back-and-forth, but the takeaway was that I owed the $45.4K, but that the terms were extended until September 20, 2018. That was a big relief–there was no way my pre-wife and I could have come up with the money in that time.

I made sure to record that conversation should things go awry again. Check the laws in your state… my state is a two-party state which means that I needed the rep’s permission to record the conversation.

The final $20K

Because FMS can’t schedule more than 12 payments at a time, I end up talking to them about once a year. While re-upping my payments for this year, the rep mentioned that for whatever reason, Sallie Mae was accepting settlements “for pennies on the dollar this month”. That’s just a figure of speech, so I didn’t know if that was literally pennies or what, but she asked if I was interested in seeing if they would re-negotiate the settlement, because I’d basically paid $35K already, and was a model citizen. Of course I said yes, and they offered me their default settlement of $24K on the $35K owed on the spot, which is 68 cents on the dollar. I told them I couldn’t do more than $10K–a true statement–fully expecting a counteroffer for somewhere between $10-20K, whereupon we’d have to borrow some money from my wife’s parents. They said they’d have to call SLMA to see if they’d approve it.

The next morning, I got a call back: Sallie Mae had approved the $10K for the remaining $35K. The rep was shocked. The manager was shocked. They told me no one in the office had thought it would go through, which I believe. I get the feeling I’m going to be an office legend for the foreseeable future.

Recap

- $144,586 original balance

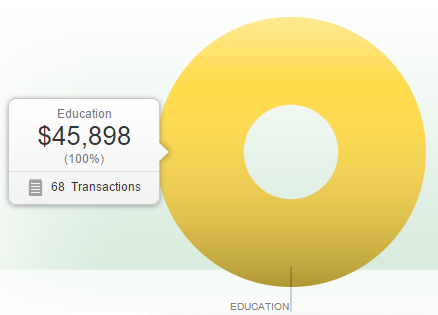

- $45,898 paid over 3.25 years

- $98,688 saved

- 68% discount (or 32 cents on the dollar) when all was said and done

FMS payments

Here’s a Google spreadsheet that shows all the debits over that time. Alternatively, you can download the Excel version.

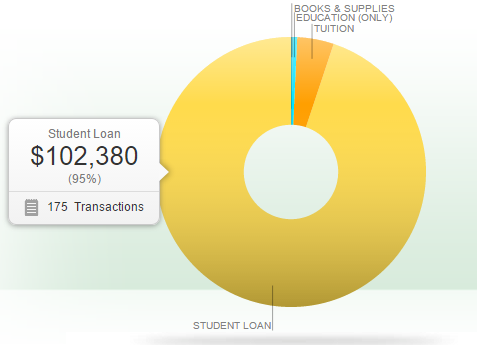

Total student loans paid during this time

I have more traditional subsidized and unsubsidized student loans that actually had interest rates, so I focused on overpaying those during this time.

Conclusions and tax implications

Once you wrap up your settlement, you’ll have taxes to pay. In my case, my income tax burden for 2015 is now my salary + $98,600, which is… a lot. Depending on where you are financially, you may be able to reduce the canceled debt “income” by whatever your net worth is, if it’s negative by filing a Form 982. To determine if this is available to you, you can fill out the worksheet on page 8 of this IRS form. If the sum you come up with is negative, you can subtract that amount from your paper “income”. (I suggest you talk to an accountant if this applies to you, though.)

Other options include maxing our your pre-tax retirement contributions (401k/403b), and/or using your FSA plan to do something expensive like getting the LASIK you always wanted. Unfortunately, doing this latter thing requires knowledge ahead of time that you’ll be settling during this particular FSA year.

Otherwise you’ll want to adjust your tax withholding, because you’ll pay an underpayment penalty in addition to the tax on this “income” if you don’t pay enough tax throughout the year.

So I settled on a settlement saving my wife and I about $100,000 and ten years. This will let us buy a house and start a family years earlier than we had thought we’d be able to. I think my situation may be unusual, but I don’t believe for a moment that I am a beautiful and unique snowflake. Three and a half years ago, my Sallie Mae situation seemed hopeless, and now… it’s over. It took a lot of hard work, and an unwavering focus to get here, but it can be done.

If I can do it, so can others.

Addendum – June 1, 2015

I wrote this article back on March 22 — 3.5 months ago. I had expected to be able to publish this much earlier, when I got the statement that our business was concluded. During this period, a few things happened

- I never received the paperwork stating that I had fulfilled my side of the deal

- Sallie Mae/Navient and FMS parted ways as business partners, which made it harder for me to get information from either one of them

- I had to fight with Sallie Mae/Navient in an attempt to get them to send me paperwork. They never did. When I talked to them on the phone, they stopped allowing me to record our conversations for some reason

Until today, I had no idea whether this was really done or not. I pull my credit report every year, and was expecting to wait until the summer in order to see if the status of my Sallie Mae/Navient loans were changed. But I bought a new car last week, and part of the financing involved the dealership pulling my credit report, which I was able to take a picture of. It indicated that the loans were settled for less than the balanced owed.

I feel reasonably confident that this is the end. Finally.

Leave a comment

- If it’s your first comment on my blog, it will probably go into the moderation queue. Don’t worry, it’s not lost; I just need to approve it. It could be a few minutes, hours, or days. I will get to it, though.

- Try to explain how your situation is different than people that have commented before you. Questions that amount to “I owe money, but can’t afford payments. What should I do?” aren’t constructive.

- I will assume all questions are about private loans only. Federal loans are a completely different kettle of fish.

1099-C update – Feb 2, 2016

I received ten(!) 1099-C forms from Navient on Jan 28. When I reported them on my taxes, I collapsed them down into a single entry for the total amount. I also filled out insolvency Form 982. I was deeply insolvent at the time of the discharge, so instead of paying income tax on an extra $115,282, I only paid income tax on $32,313, because I was underwater by $82,969.

I used TaxAct, which made the process very straightforward. I collapsed the ten forms into a single line item because TaxAct cannot handle more than five 1099-C forms, and their Form 982 worksheet can only be applied against a single line item. We’ll see if the IRS complains. (I don’t know why they would:- the numbers are identical whether they’re reported across ten line items or one.)

Settlement amounts from other readers

- $30K for $8K or 27 cents on the dollar – Jan 2016.

- Update Feb 2017: his tax bill was $6,500–$4,500 federal / $2,000 state

- JKÂ owed $107,000 and I asked them to settle for $8609 which was 10% of the unpaid balance before interest. It was accepted the next day and paid.

I’m fairly certain my entire blog post covers what I did in your situation.

Thanks SO MUCH for your candor, this article is incredibly helpful!

I am in a similar predicament to where you started – now 5 years out of school, current total debt of $126K, $103K of which is private. My cosigner on two private loans making up the bulk of my debt recently ended a bankruptcy which has brought them into repayment, and my total monthly payments up to $1,700, much more than I can afford.

A few questions for you:

I had a cosigner who had just gone through a bankruptcy; it had no bearing on my negotiations. I was never sued, and I never contacted a lawyer. I did everything myself.

How do I tell if my loans are owned by Sallie Mae of the Federal Government. The paperwork states that they are consolidated FFEL loans but up until the time I went into default in 2012, Sallie Mae was the one making the calls and sending me the paperwork!

If they are Federal loans, and I rehabilitate them, will I be allowed a 20 year payment plan to reduce the monthly amount given my total balance is 90,000 including collection fees?

Will they also remove the collection fees once I rehabilitate the loans and make the 9 required payments?

Your blog is so helpful! Thanks Rian.

Hello,

My name is camile, I’m currently a sophomore film major, I will have the same if not more debt that you, what should I do to make sure that I don’t suffocate?

Get out now before you’re buried under a catastrophically huge amount of student debt. Continuing in film school while on your way to $180K in debt is a monumentally stupid idea that will haunt you for at least 20 years after you graduate. You are looking at $1200-1500/mo student loan payments on the low side, assuming you don’t defer.

If you defer–and you will, because you’re studying film where prospects for a six-figure income right out of the gate are slim to none–your payments will be much, much higher, because your balance will grow and grow. (Read the comments by the people that have posted here if you don’t want to take my word for it.)

There is no magic math that will make it all better if you continue the path you’re on.

I wish, I wish, I wish someone had somehow made me understand this years ago before I dug myself into the hole I was in.

I feel I could qualify for interest Rate Reduction program. I’ve read bout it and lei looks like it could really help me

Hello, I wanted to know if filing an adversary proceeding along with filing bankruptcy would work towards a settlement with Sallie Mae. All of my loans are through them and I’m currently under the IBR plan. I’m thinking of going out on a limb and suing them by myself but wanted to know how did you get their attorneys address to summons them or did you use Sallie Mae’s current address? Thank you!

You just said a bunch of words that have nothing to do with anything that I’ve written in the article or in the comments.

I have two loans- a private loan from naivent. That loan is 3700 now… And I have a federal consolidated loan for 25k. How did you go about negotiating? Were you blunt? I’m a bit nervous to call and ask for a reduced total.

Hello,

I have reached a settlement over the phone. They are asking for my bank account routing number or credit card because they would like to be able to put in writing our agreement. I was wondering if you provided such information. Where and whom did you send a check? I have heard and seen so many scams I don’t want to end up in one.

Also, were your debts immediately removed from your credit score?

I have been considering whether or not to quit paying my private loans. My interest rate is at 10% and I currently owe more than what I originally borrowed. Do you think they can take your house or car if you stop paying? I would like to try to get a settlement, but I know they won’t work with you if you are current.

Hello,

Me and my boyfriend (want to get married but student loans are stoping this) are dealing with Navient right now. It was Sallie Mae until recently. We;ve been paying 250 a month for the past year, and are on an interest plan on 0.01%, right now were at $100,000 in private student loans. It’s been really hard to continue with the 250/month and we’ve missed the last payment. We want to try to do something similar to you, but when we get on the phone with naivent they never offer anything like

“Made a $7000 down payment by the end of the month

Paid $800/month for 45 months

At the 0.01% interest rate”

Since this was offered to you and you didnt really ask or it, how do we go about proposing the idea? 7000 would be a lot to deal with right now, and maybe we wont be able to do it right now, but I’m just wondering if you can tell me how you maneuvered around this part of the deal a little more in depth?

And if we cant do it right now, would you suggest we keep paying the $250 a month until we can do something like that? The loan is already in default and they wont take it out of default. We don’t know if its better to keep paying, or stop paying and try to save some money for some kind of settlement with the money we would have been paying them every month.

Were you ever worried about wage garnishment when you stopped paying?

Thanks!

Did the settlement hurt you on your credit report? I was told by Navient that a settlement is bad for your credit and it will stay on the report for 7 years? is this true did this happen to you?

A settlement is better than a default, but not as good as “paying as agreed” or “paid in full”. And yes, of course it went onto my credit report, which you would have seen if you had read the article.

I haven’t heard of them taking a house or a car. In fact, I believe that primary residences and primary modes of transportation are protected if you go bankrupt. You can’t discharge student debts in bankruptcy, but I suspect the guidelines are similar. In any event, they would have to sue you. It wouldn’t happen overnight.

Back story – I’m the student and borrowed 24K in student loans. I’ve paid off 4 of the 6 and only two remain (roughly 7k total) that were sallie mae loans that transferred to Navient a few years ago but no disruptions in service or payment. $100/mo for the last 8 years. I’ve never missed a payment and like to send them chunks of money when I can to pay the loan down faster.

My mom has 3 loans.

Loan 1-01 has been paid every month since 2006 (other than a full year of forbearance in 2010 when she divorced my dad) I know because I sign into her account every month and submit the payment.

In May 2015 Navient bought two loans (loan 1-02, loan 1-03) from a collection agency and it posted to my mom’s navient account. She was never aware of the loans and has since racked up 2x the principle in interest. As of January 2016, one of those loans (1-03) is now on my account and they are claiming I’m the co-signer. I now owe $37k for my mom’s consolidated loan on my navient account online.

Navient claims I’m the cosigner to a parent loan from a promissory note signed in 2004. They only have the promissory note from a consolidation in 2007 and I’m listed as the student not as a cosigner. I’ve requested to be removed as the co-signer. They have the “office of the customer advocate department” looking into the case, and it’s to prove that I signed a promissory note as a co-signer PRIOR to the consolidation promissory note in 2007.

What gives? Can they do this 10 years after the fact? I never knew about this loan, neither did my mom, or has it been on my credit history. Have you heard of a student being a co-signer on a parent loan that is covering the additional tuition that the student’s loan won’t cover? Oxymoron, am I right?

I didn’t send a check. It was an electronic debit using the same account I had been making payments out of. I did have the option of specifying a different account for the one-time payment, though.

I don’t think I had the credit card option.

My defaults showed up as “settled for less than amount owed” on my credit reports pretty quickly. I explained as much in the article. Maybe you should read it?

No, they offered me the settlement the first time I talked to them, but I had been in default for a long time, so it was in their interest to do so. I don’t think they’ll negotiate if you’re in good standing.

I suspect this is a common thing in loans (not just student loans), and I suspect that it has fairly standard remediation processes. I bet someone fat-fingered something during the data-entry process, and it will be straightened out. If not, you’ll need to escalate.

I have no idea.

Caneisha any one please tell me about getting rid of the interest off my student loan, my balance is about $56,000.00 but with the interest it is taking it up over 117,000.00. I feel that I am getting ripped off herE on this interest. I am not sure what to do.

I am currently in default with my loans and living abroad, but wanting to move back to the USA. I have had calls over here in Europe from collectors. They’ve spoken of loan rehabilitation, do I need to do this before trying to settle, or can I follow your path right away with trying to settle? I’d really like it resolved before moving back. My loans from 2000 and I am also living abroad, I hope that will give me some room for negotiation.

My private Sallie Mae balance is 250,000k plus. They want over 3k a month from me which isn’t possible. My first payment was just due yesterday and they already call multiple times a day. Based on your article I need to wait for them to default and sell them to a debt collector? When should I start the negotiation process?

I was able to settle my 60k of debt for 11k i had with Navient/Sallie Mae. I was surprised seems like you got thrown through the loop a bunch of times. Now i am waiting the 60-90 days for it to hit my credit report so i can or cannot buy a house depending on how the settlement impacts my credit report.

Hi there,

First of all- thanks for making this blog post. It’s encouraging to see that there are options when it feels like I’m down to the last straw. I have about 30k in debt between 2 private (used to be Sallie Mae) now Navient loans. I can’t pay the minimum and the loans are about to default this month. I keep getting letters from a law firm saying they work with Navient and they’re going to file a lawsuit if I don’t start paying minimum payments now. I didn’t see anything in your post but read in a previous comment that you did not get sued. So, getting sued is not the next step after default then?

I’m wondering if I should get a 3rd job to make the minimum payment even though I literally have no more time in my life (I’m a full time student still), or let the loans default and make a settlement as you have done. Can they/will they sue as the law firm says? Will they go after my cosigner (who is my father)? He has money but he has already helped more than he should have. Totally lost here, thanks for your help.

I defaulted on sallie Mae private loans during my divorce. These loans were sold to ancient, then to allied interstate. I fell victim to the unfair scare tactics of suing me and my co signers, wage garnishment, taking my car, calling my family, employers etc, so I stated to pay Out of fear. I have paid over 18k to this collection agency (allied interstate) over the past 6 years all interest only payments. These payments are monthly ACH transactions, and I have yet to get anything in writing to even validate the debts. I have made zero progress toward the balance, and feel like I got scammed. Has anyone ever gotten a judgement from navient/ allied interstate. Please HELP!

Hey thanks for your article. It’s the most inspiring story. Truly gives me hope.

Since reading it I actually did what you suggested with the credit card companies first. Over a few months I was able to go from @25k in credit card debt to having paid it off in using $12K (saved about 55-60%) and my credit report shows “0 Balance settled for less than original balance”.

My question to you now that I want to pay off my Sallie Mae loans is this: is there a way to try a debt settlement if about 4 months of me not paying them a cent has gotten to the point of getting letters saying “they want to work with me but If I don’t pay (what equals $1000 by 2 weeks from now) they’ll use they’ll exercise their rights under the law.”

Before reading your article i paid the minimum amount due each month ..but I realized it would never go down (the way I see it they didn’t unnecessarily kill me with interest my balances would have gone down instead of towards principle only). Basically want to know your advice for me. should I just give them the $1000 they want and then continue to pay the minimum payment each month OR do you think I have a shot at negotiating something better with them that could save me money – and like you – get out of this situation soon rather than having it drag on for another 5 years? Coming up with money from family/savings is what I’d use for my settlement.

Hi, thanks for your post, I read it carefully. I’m currently looking at settling for a defaulted private student loan with Discover Student Loans.

I want to learn more about what happens after you settle and your statement about taxes was the first time I’ve heard of paying taxes on settled student debt. Can you explain the below statement from your post a little more?

“Once you wrap up your settlement, you’ll have taxes to pay. In my case, my income tax burden for 2015 is now my salary + $98,600, which is… a lot. Depending on where you are financially, you may be able to reduce the canceled debt “income†by whatever your net worth is, if it’s negative by filing a Form 982.”

Specifically, how much would taxes on $98,600 look like? Does the IRS really consider that “income”? (And is that figure the amount of debt you didn’t pay?) Apologies if these are dumb questions. Like a lot of mid-20s millennials I’m finally trying to become more financially literate after idiotic student loans I took out when I was 18, but there’s so much misinformation out there and you seem to know what you’re talking about.

Thank you.

I have private student loans through Sallie Mae (Tuition Answer), I was told they are not guaranteed by federal government (not sure if it matters now). I defaulted on the loans and was sued (judgement entered). I still have access to my online Navient account. One of the loans is really low and I can make payment (possibly pay that one off). I want to make payments through online account and not judgement attorney, but not sure how it would be posted/accounted for.

In my previous post I didn’t give a lot of detail but after reading the above threads, I do have a couple of other questions. There are a total of 5 judgements for private loans (3 tuition answer, 2 signature) all through Sallie Mae website (2005-2008). The tuition answer loans were issued directly (not sent to school), the signature loans went to school first then issued as refund check. Total judgement amounts are approx. 15k, but not sure how much it has increased (judgements entered in 2013). I’m lost as to how to approach/offer settlement/ affordable payment arrangement. As previously stated, lowest loan is $500, which I could settle on. As for the others, I don’t know how to approach them. They are all with the same collection/attorney firm. I’m scared that if I take action on one, they will try to aggressively enforce all. I am considered judgement proof but would just like to know how to handle situation. All I hear is bankruptcy, etc. The private student loans is my biggest debt/financial drawback. Any positive feedback would be appreciated.

Thanks for the blog.

Has anyone ever actually read their Promissory Note? Make sure you gave permission for the lender to shove their shit off to someone else. Legal term “or it’s assigns”.

I don’t believe the “parent” loan can just sell it or transfer the power unless you signed off on it.

READ YOUR PAPERWORK!!!!

Just settled with Navient today: $32k outstanding, settled for onetime payment of $6k or 19 cents on the dollar. They already sent me the confirmation that it has satisfied all debts. Just ignore their calls and letters for 6 years and when you finally call they will work with you.

Hi I am in the process of cosigning with my parents for a 43,000 dollar loan with Sallie Mae. Could you give me any advice on loans in general or other companies to apply to if this request doesn’t work?

Hey,

I am currently a graduate student who owes 46K in Sallie Mae Loans and about 30K in Federal. Would it be crazy to ask my financial aid office for more money next school year (it’ll be Federal) and use that to pay at least half my Sallie Mae loans?

I owe $95,474 in private loans I have been paying all of the last 8 years. I am on an interest rate reduction plan for another 11 months at 3% paying $580. Then $700 for 18 more years…

My parents are cosigners of 1 loan for 31K.

I don’t have any assets but I would like to buy a house because I’m concerned that if I stop paying I won’t have good credit anymore and I currently have 0 debt besides these loans.

I will finish paying over the age of 50. I’m concerned this will greatly affect the lives of my family. Right now I have good credit any advice for what the best course of action would be. My mother’s credit is terrible but, my father will likely be angry if his credit will be affected forever by this…Any advice for buying a home, eliminating the cosigners and hiding my home from them?

I was told by Navient that my loan has been purchased by a debt collector. However, because I have a cease and desist on the loan, the debt collector hasn’t called me yet. I’m debating whether to remove the cease and desist to see what happens. FMS is not the same as a debt collector that buys defaulted Navient loans is it? Thank you.

“Just settled with Navient today: $32k outstanding, settled for onetime payment of $6k or 19 cents on the dollar. They already sent me the confirmation that it has satisfied all debts. Just ignore their calls and letters for 6 years and when you finally call they will work with you.”

Do am I reading this correctly, that you need to be in default in order for them to offer or accept a settlement? People who have been paying their loans faithfully, in good standing, they won’t discuss a settlement?

After reading on your advice, I am on the process of considering defaulting on my student loan with Discover. I have have not been paying for the last 3 months and I have received a letter in which they tell me the loan is at risk of default adn there’s still chance to bring it up to date. I am not really willing to continue giving away only interest money. My question this time is if I should recur to a deferment or other arrangement prior to going into default in order to increase my chances of getting a debt settlement option once in default or if I could go straight into default. What is the time frame in which I should call in order to talk about a debt settlement, could I do this within 1-2 months after defaulting or must it be years even?

Also, lets say I enter into a debt settlement. Since I am international student, how would the tax issues work in this case with the IRS?

Hello,

I have been talking to GC Services who claim to have been hired by Sallie Mae (Navient). My loans have been on default for at least 3 years. They offered me a settlement, and after some negotiation, I think that we are very close to reaching an agreeable amount (~20% of the Balance or 80% off). I was wondering if anyone here knows what type of attorney (I live in Chicagoland) can review a settlement offer to make sure that it is legit and that it includes a pay in full statement. They claim that they will provide a full written offer (with all the amounts and account numbers) once the settlement amount is approved by Sallie Mae. They did tell me that the settlement offer will come from GC-Services, not Sallie Mae but that they are authorized to make these offers. They told me that I can call Sallie Mae (once the offer has been approved to verify) but I want to have an attorney look at it as well. I have read some stories where the settlements were not legit, and then had to continue paying the debt even after paying the settlement amount. Can someone please advice? Thank you in advance for your help.

I graduated in 2010 and returned to school for a little more before my father became sick. My current debt is $130,000 +interest, with 2 years of school to go. My father has now passed and I have come into an inheritance. I was told by a “loan lawyer” (that I paid $200 for a 30 minute phone conversation) to attack my private loans first as they are harder to negotiate with; the only way to negotiate my private balance was to default in payments which I decided against in order to save what little credit I have. I’m not sure I want to keep Navient as I’ve heard there are other companies with lower interest rates that may offer a better settlement on my federal loans. I want to make sure I’m paying the right person before I write such substantial checks. I’ve been tossed around on the phone any and every time I call Navient, if I’m not hung up on first.

My mother is a co-signer and we both, and now my sister, are harassed daily with phone calls and letters mailed. She desperately wants her name off my loan (which I was told by the “lawn lawyer” will only happen when the balance is paid) and an end to the phonecalls- as do I.

I’m not sure how to ensure my father’s money is going to the right place. I never feel like I’m given a straight answer when I speak to Navient or the collection agency they’ve hired (GSMR and/or FH Cann & Associates). I finally think I have my numbers figured out, thanks to my Financial Aid rep at my current school, so I know how much is private and how much is federal.

How do I handle Navient? How can I fire them and rehire a new company? How can I ensure the new company will offer me something better than Navient? Can I make a settlement on my federal loans if I pay a substantial amount towards them? And then how can I ensure that settlement is the best they can give me?

Thanks for this blog! My “millennial” generation needs more advocates for student debt; we’re pushed and pushed into college after high school but not really educated on the debt, interest, and financial setbacks we’ll be facing upon graduation.

I just called Navient, and they said that they would not settle any federal loans – ever. However, like the person above, if you are in default for many years I think they will work with you, but like most of us honest folks, I’m not in default. It seems unfair that the only way to get a settlement is to go into default for a number of years.

Your implication here–whether you realize it or not–is that people who default are fundamentally dishonest, which is ridiculous. C.f. the just world fallacy.

-Rian

I see you said you had a cosigner. With all the negotiations you had was the cosigner involved at all? Wouldn’t Sallie Mae just go after the cosigner even if they had declared bankruptcy?

Would you please provide best direct contact for those with authority to negotiate settlement within Sallie Mae/Navient? Thanks

Thanks for you post it really helped me…. I settled my loan with salliae Mae / naivent. I had 108,000 student private loan but paid lump sum of 30,000 , 3 month ago due to default in payment… I finished school 2010 and I didn’t pay dime till 3 months ago 🙈🙈🙈. So my question I know I will get the 1099-c but my income is 95,000 per year … My tax from my job is 25% (single) no house or kids …. How do I get to reduce my taxes on the settlement

Your taxes are already fixed. There’s nothing you can really do to reduce your tax burden, except to make sure you max out your 401k this year.

You’re going to be asked to pay taxes on $78K of additional income for 2016. You’re probably insolvent to some degree, so the IRS will require you to provide documentation about your assets at the time of the settlement. Have a look at my blog post for the insolvency form 982; you can fill it out now. If you had assets of more than $78K at the time you paid the settlement, you’re going to have to pay taxes on the whole thing.

They went after her for a while, but once I started the settlement payments, they stopped. She wasn’t part of the negotiations at all. It was just not a factor.

Thanks for all of this Rian!

This week (hopefully after I hear from you) I will attempt to settle parent-plus debt directly with Navient . I owe 106K! I do have the means to off er a lump payment up to 40K . I have been delinquent for some time and I do ignore their calls…like the Yoda above :). Any last minute advice you can offer would be GREATLY appreciated. I will post back how things went. Thanks again.

Call them up, tell them you want to settle. See what they offer. (It will be high.) Counter offer 10-20% lower. They’ll probably take a day to accept or counter. At the very worst, you can go back and accept their original offer.

Thanks Rian.

Called Navient…told them I would like to settle my debt with a lump payment. “we don’t settle Government owned loans”. Called 3 times talked to 3 different folks at different times of the day. They did say they would work with me on “payment options” but no mention of reducing principle or interest at all. I guess my next step would be to here them out. Suggestions? ThxM