March 22, 2015

This article is for people who have defaulted on their Sallie Mae/Navient student loans. If you haven’t defaulted, or if you’re paying traditional subsidized or unsubsidized federal loans, this won’t work for you. For those of you that ARE in this position, this post is for you. You can get your life back.

I’m sharing all of my actual numbers, because it makes the conversation more useful.

Managing the chaos

Like many people, I was unemployed in 2009-2010. I had the bad fortune of graduating in the middle of the recession, and had quite a bit of difficulty finding a “big kid” job, i.e. one that would let me pay my bills–including my student loans. Also like many people who are struggling with debt they can’t pay, I was plagued by phone calls, and they were universally unproductive, because stones don’t have much blood to give. The first step to getting your feet under you is to create mental space, and the biggest thing is to stop the unwanted calls.

In addition to sending letters, I did this:

- Get a Google Voice number

- Log into your delinquent accounts, and use the Google Voice number as your only phone number

- Don’t answer numbers you don’t recognize

- Take down each collection agency’s contact information (phone number, debt they’re collecting on, etc.) when they leave you a voicemail

- Block each caller one by one

This builds a strategic rolodex for tackling your debts when you’ve got your feet under you. If getting back on your feet takes a while–it took me 2 years–you’ll notice that debt gets resold fairly often, and as it gets resold, the settlement offers get better and better. This is particularly true for unsecured, consumer debt, and less true with student debt.

Negotiating with Sallie Mae/Navient and FMS

Sallie Mae stops trying to collect debts themselves fairly quickly, and they tend to outsource this to other agencies. Unlike consumer debt, Sallie Mae does not sell the debt to the servicing organization. Instead they retain ownership of the debt, as well as the terms and conditions under which that debt may be settled. (In fact, if you try to call Sallie Mae directly, you will be redirected to the servicing agency without ever having talked to a human being.) The debt collector is just a proxy, but they’re the ones you’ll be dealing with.

My debt was serviced by an organization called FMS. You can Google them; there are many horror stories, but my experience was pretty good, barring a few incidents. I had settled a couple of smaller credit card debts to this point, so I made sure to unblock their phone number only when I had a small lump of money available to make a down payment. I knew I wasn’t going to be able to discuss a full settlement, but maybe I could do something to move the needle in the right direction. This ended up being a good move, though the benefits weren’t obvious until much later.

Default settlements

I’m going to use the term “default settlement” below. I don’t know for sure, but I believe that Sallie Mae’s proxies are authorized to offer some percentage (65-70% or so) as a settlement amount, without phoning the Sallie Mae mothership. The reason I believe this is true, is because they would periodically offer me settlements on the spot which didn’t require them to phone home. This was in contrast to my counteroffers which required a ~24-48 hour turnaround time where they had to talk to someone with more authority.

The reduced-interest plan

June 2011 balance: $144,586.

I brought my account up to date on July 25, 2011 with a $1,493.38 payment, and set up a recurring payment every two weeks for $372.56. This was their “reduced interest plan”, where the interest rate dropped to 0.01%. There was no discussion of a settlement at this point that I can recall. If there had been, it would have been WAY more money than I had, so it didn’t matter.

I made bi-weekly payments from July 2011 to May 2012.

The first settlement offer: the first $80K

In May 2012, I got a phone call from FMS to re-up my recurring payments. (They can only schedule 12 at a time.) At this time, the rep I had been dealing with all along offered me a settlement that was still too large for me to take advantage of in one shot. I told her as much, and if I recall correctly, she conferred with her manager and the Sallie Mae mothership, and they made me a counter-offer: an $80,000 reduction if I:

- Made a $7000 down payment by the end of the month

- Paid $800/month for 45 months

- At the 0.01% interest rate

This dropped the loan term from 155 months to 45 months, a 9+ year reduction. BUT, if I broke the terms, the full balance came back at the original interest rate, minus whatever I’d paid. I went for it, because saving $80,000 and 9 years was too good to leave on the table.

- Settlement starting balance: $45,375

- Made the $7000 down-payment (with my dad’s help) in May 2012, which

- Reduced the amount left to pay to $36,375 (or so I thought, more on that below)

I set up a $400 recurring payment every 2 weeks, including months with 3 weeks to ensure I’d make the deadline with some headroom.

A bump in the road

Unfortunately, FMS wouldn’t send me paperwork stating the terms of the settlement, which (as I suspected) came back to bite me. I also hadn’t recorded our phone conversations, because until this point, there was no reason to think that I would need to.

December 2013 rolled around, and I received a phone call telling me that I was almost out of time, and that I owed like $45,442 by ~February 2014, which didn’t sound right. Unfortunately, I was dealing with a new representative, and she couldn’t decipher the notes of the previous representative. It was my notes against theirs… and when you’re in this position, the other party holds all the cards; you’re just along for the ride, hoping they don’t fuck anything up too badly. (That said, I’m very confident that my notes were more accurate. Not that it mattered then, and I can’t imagine it would have mattered in a courtroom.)

There was about a week of back-and-forth, but the takeaway was that I owed the $45.4K, but that the terms were extended until September 20, 2018. That was a big relief–there was no way my pre-wife and I could have come up with the money in that time.

I made sure to record that conversation should things go awry again. Check the laws in your state… my state is a two-party state which means that I needed the rep’s permission to record the conversation.

The final $20K

Because FMS can’t schedule more than 12 payments at a time, I end up talking to them about once a year. While re-upping my payments for this year, the rep mentioned that for whatever reason, Sallie Mae was accepting settlements “for pennies on the dollar this month”. That’s just a figure of speech, so I didn’t know if that was literally pennies or what, but she asked if I was interested in seeing if they would re-negotiate the settlement, because I’d basically paid $35K already, and was a model citizen. Of course I said yes, and they offered me their default settlement of $24K on the $35K owed on the spot, which is 68 cents on the dollar. I told them I couldn’t do more than $10K–a true statement–fully expecting a counteroffer for somewhere between $10-20K, whereupon we’d have to borrow some money from my wife’s parents. They said they’d have to call SLMA to see if they’d approve it.

The next morning, I got a call back: Sallie Mae had approved the $10K for the remaining $35K. The rep was shocked. The manager was shocked. They told me no one in the office had thought it would go through, which I believe. I get the feeling I’m going to be an office legend for the foreseeable future.

Recap

- $144,586 original balance

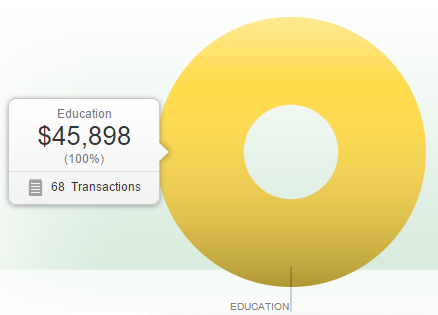

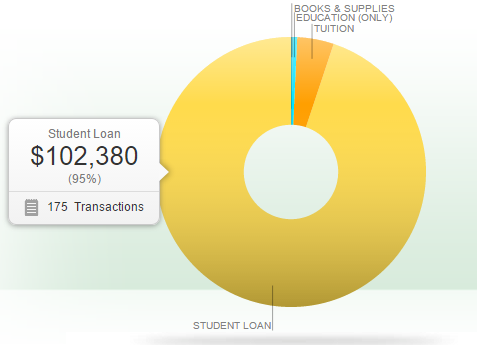

- $45,898 paid over 3.25 years

- $98,688 saved

- 68% discount (or 32 cents on the dollar) when all was said and done

FMS payments

Here’s a Google spreadsheet that shows all the debits over that time. Alternatively, you can download the Excel version.

Total student loans paid during this time

I have more traditional subsidized and unsubsidized student loans that actually had interest rates, so I focused on overpaying those during this time.

Conclusions and tax implications

Once you wrap up your settlement, you’ll have taxes to pay. In my case, my income tax burden for 2015 is now my salary + $98,600, which is… a lot. Depending on where you are financially, you may be able to reduce the canceled debt “income” by whatever your net worth is, if it’s negative by filing a Form 982. To determine if this is available to you, you can fill out the worksheet on page 8 of this IRS form. If the sum you come up with is negative, you can subtract that amount from your paper “income”. (I suggest you talk to an accountant if this applies to you, though.)

Other options include maxing our your pre-tax retirement contributions (401k/403b), and/or using your FSA plan to do something expensive like getting the LASIK you always wanted. Unfortunately, doing this latter thing requires knowledge ahead of time that you’ll be settling during this particular FSA year.

Otherwise you’ll want to adjust your tax withholding, because you’ll pay an underpayment penalty in addition to the tax on this “income” if you don’t pay enough tax throughout the year.

So I settled on a settlement saving my wife and I about $100,000 and ten years. This will let us buy a house and start a family years earlier than we had thought we’d be able to. I think my situation may be unusual, but I don’t believe for a moment that I am a beautiful and unique snowflake. Three and a half years ago, my Sallie Mae situation seemed hopeless, and now… it’s over. It took a lot of hard work, and an unwavering focus to get here, but it can be done.

If I can do it, so can others.

Addendum – June 1, 2015

I wrote this article back on March 22 — 3.5 months ago. I had expected to be able to publish this much earlier, when I got the statement that our business was concluded. During this period, a few things happened

- I never received the paperwork stating that I had fulfilled my side of the deal

- Sallie Mae/Navient and FMS parted ways as business partners, which made it harder for me to get information from either one of them

- I had to fight with Sallie Mae/Navient in an attempt to get them to send me paperwork. They never did. When I talked to them on the phone, they stopped allowing me to record our conversations for some reason

Until today, I had no idea whether this was really done or not. I pull my credit report every year, and was expecting to wait until the summer in order to see if the status of my Sallie Mae/Navient loans were changed. But I bought a new car last week, and part of the financing involved the dealership pulling my credit report, which I was able to take a picture of. It indicated that the loans were settled for less than the balanced owed.

I feel reasonably confident that this is the end. Finally.

Leave a comment

- If it’s your first comment on my blog, it will probably go into the moderation queue. Don’t worry, it’s not lost; I just need to approve it. It could be a few minutes, hours, or days. I will get to it, though.

- Try to explain how your situation is different than people that have commented before you. Questions that amount to “I owe money, but can’t afford payments. What should I do?” aren’t constructive.

- I will assume all questions are about private loans only. Federal loans are a completely different kettle of fish.

1099-C update – Feb 2, 2016

I received ten(!) 1099-C forms from Navient on Jan 28. When I reported them on my taxes, I collapsed them down into a single entry for the total amount. I also filled out insolvency Form 982. I was deeply insolvent at the time of the discharge, so instead of paying income tax on an extra $115,282, I only paid income tax on $32,313, because I was underwater by $82,969.

I used TaxAct, which made the process very straightforward. I collapsed the ten forms into a single line item because TaxAct cannot handle more than five 1099-C forms, and their Form 982 worksheet can only be applied against a single line item. We’ll see if the IRS complains. (I don’t know why they would:- the numbers are identical whether they’re reported across ten line items or one.)

Settlement amounts from other readers

- $30K for $8K or 27 cents on the dollar – Jan 2016.

- Update Feb 2017: his tax bill was $6,500–$4,500 federal / $2,000 state

- JKÂ owed $107,000 and I asked them to settle for $8609 which was 10% of the unpaid balance before interest. It was accepted the next day and paid.

Nice article and great tips. My wife and I are in the same situation (total current between the both of us exceeds $200k and are seriously defaulted). We finally decided to get everything back on track, and since we are defaulted they are now willing to work with us and provide reasonable plans.

Every time they call they offer a settlement amount if paid in full but we are not in a situation that we are able to make such a large lump sum payment.

Do you or anyone know if one is able to take out a different private loan (if approved), and pay the settlement amounts with said loan? Then just make payments on the new loan (possibly at a lower interest rate) with a much lower principle balance.

Sure, you can pay loans with other loans. So long as the money clears, they don’t care what the source is. I would probably look at a p2p lending organization like Prosper or Lending Club.

Did Naviemt take you to court or try to serve/sue you? Thanks.

How do we claim insolvency? Navient is trying to settle for 30% of my loan.. They’re forgiving $3,000 but I don’t want this to hurt us come taxes. We only live off of $26,000 a year.

Hi. Just wondering if you had a co signer and if so, what happened to them during this process.

I am three months behind on a private student loan that’s over 100k. I will be able to pay it off next week but will be back in the same boat unless my financial situation changes. I am wondering if I am better off letting it default so that I can receive better repayment offers. It’s a sallie Mae tuition answer loan

Awesome article. I owe 84k and I just consolidated my loans (ISAC & navient). But they way it’s set up is crazy. Interest rate is 6.5% (I’m on that 30 year plan) it’s going to take forever to pay it off. Do you think I can call and get a settlement with navient? Would they want 50% and call it even?

Or what advice would you give me?

Thanks

Hi Rian,

you have given me peace of mind after having to tell Navient and Discover I cannot pay over $350,000 (yes, you read that right: ~$250,000 in Federal Sub/Unsub and $100,000 in Private Student Signature) in student loans a few months ago. It is impossible for me to pay and I had gotten to the point that I couldn’t function because I was so depressed that I could barely make my payments. I can’t get a new job due to my credit score and I am stuck teaching for literally $20,000 a year (with no benefits) at my alma mater as an adjunct lecturer. I am also a single mom to a child with severe autism. I can only make money under the table doing odd jobs to get by. It’s pretty messed up, but I don’t see a solution for where I am at.

The calls started over the summer and I put them all on call forwarding to my VM and I have it so I don’t see any notifications that they called. Anytime I see a new number I note it and hit the ignore button. So I’m not stressed out any more, which has given me the ability to search to see if anyone out there has been in the same situation. So I’m very thankful for your article.

For the $250,000 in Federal loans I am on the income based plan, so due to my income I owe $0 a month currently (so these are not in default as long as I show my tax records yearly). But for the $100,000 in private loans, I have not made payments due to no money to give since May 2016. I anticipate that it’s going to be like this for a while till I can somehow save up money after a handful of years to pay (possibly 5-10 years I’m guessing). Anyways, I wanted to ask about if it is possible that for the private loans in default if they (Navient or other collector) can take money out of my bank account without notice? I ask because I need to save up obviously or should I be super careful where I put this money? Should I save it as cash in a secure place, have a friend I trust save the money in their bank, or am I being ridiculous and just not worry, this saving it in my own account?

How careful should I be and how long should I wait to start negotiations (like at what % of what I owe that I should focus on saving)?

Thank you

I am 67, in school full time and working .

Navient told me that I have been in school enough and it is time to pay my debts to them.

Navient issued a litigation registered letter.

I am trying to achieve my return to college in my 50’s and make a good job course for myself that also is responsible to debt.

I am very interested in how you accomplished this and would love to speak with you. I currently am 120 k in debt have an autistic child and I am slowly sinking.

I told the full story in the blog post. There is nothing more to tell.

Wondering how your credit score is so good despite the previous default. Did it not go up until you settled the account in full? I am trying to buy a house now but have not been able to get approved for a mortgage because of my credit score. The analyst said my low score is mostly from my late payments to Navient (who I am not current with) and that I defaulted on my AES loans (one 15k and one 14k loan). I tried getting Navient to do a good will adjustment on the late payments (I have six different loans through them and every time I was late they dinged me six times so I have a ton of late records), but they refused. I’ve gotten conflicting info on whether I should pay off the AES loan. I don’t have the means to completely settle but I can definitely start making monthly payments- but not sure if that will even help my credit at this point. Any advice? It’s so hard dealing with these people and not getting discouraged. I am just trying to make a better life for my son and I but with a credit score of 530 I can’t do much.

Because it had been five years without any new black marks on my credit report when I wrote this blog post. During that time, I focused on making moves that would dig me out of debt. I purposely avoided any activities that would juice my score in the short term, and focused purely on long-term debt reduction. (Which is an excellent way to repair your credit, as it turns out.)

I did one thing which might have helped… I don’t know. I kept a credit card at a $0 balance while defaulting on my others. I kept it at $0, because I wanted to be able to at least have something to signal that I was no longer a bad risk when the time came. That was my Discover card, which worked out well later because they started offering a credit card that gave you a monthly FICO score, which saved me a few bucks as time went on. (I used to pay for my scores twice a year.)

I used to keep a spreadsheet tracking debts and credit scores and payoff dates. I still track my credit scores, and probably will for another year. (All my delinquencies fall off by September 2017, so my score should shoot up after that.)

Here’s a rough timeline, based on my tracking and notes to myself:

I think it’s just a matter of time for those delinquencies to fall off; I think they’re the main thing holding my score back.

Your problem is not your credit score. Your problem as that you’re drowning in debt. I’m not going to sugarcoat it: a mortgage on your own isn’t going to be a reality for you for probably 5-7 years. Maybe longer, depending on how long it takes you to dig out. See below on how I would approach digging out. I would redirect your efforts towards digging out, not incurring more debt. (And yes, I realize that mortgages are often cheaper than paying rent.)

Until your head is above water, mortgages (and other loans) are off the table. All the other stuff you’re doing is just rearranging deck chairs on the Titanic.

OK, so if you’re ready to dig out instead of rearranging chairs, this is what I would do:

If the Navient loans are private, just stop paying them. Settlements can be negotiated on those later. The longer you go, the more likely they are to accept lower and lower settlement numbers. In the meantime, redirect money into savings.

If AES is private, just stop paying it. That can also be negotiated like the Navient loans. If it’s a federal loan, rehabilitate it. (You can do this once.) Once it’s rehab’d, switch to income-based repayment (IBR), and continue directing money into savings for a loan settlement with Navient.

Your problem is that you’re drowning in debt. Solve that problem, and the score will take care of itself slowly. My approach here does both.

Did Navient sue you or try to take you to court?

Was it just a standard collections debt letter and no court appearances, no serving?

I’ve got $100,000+ in private student loans, and worry about being taken to court. I’m way under the garnishment level in my state, straight up poverty, but still dread it.

I wasn’t sued, no. My loan total was much higher than yours.

-Rian

Hello,

Very interesting and enjoyed hearing about your success. I too am in some student loan debt. I have 44k in private navient loans and another 25k in government. I recently received a decent sum of money, 45 thousandish from selling some real estate. My question is do you think I should call navient to see if they can reduce the amount I owe or just straight pay them the 44k? I have never missed a payment with them but I do want to get the most bang for my buck and reduce these student loans the best I can.

Thank you,

They won’t negotiate if you’re in good standing.

-Rian

Saw this question which was not answered, but I have the same concern: did you have a cosigner on those loans? If so, what happened to them when you defaulted?

It hurt her credit rating, but she had gone through a bankruptcy a year or two before that, so the hit wasn’t that bad. (In fact, it may not have lowered her credit score at all, but it’s hard to know for sure when you’re starting point is 400-something.)

Other than that, it was the same that happened to me: lots of annoying phone calls, and what was about it. She was cosigner on my private loans, not my federal.

-Rian

Rian:

I must tell you, after reading your site, I am encouraged in that, you give us insight into the numerous scenario’s and sound advice that up until this point, I had not realized there were so many others in the same position searching for advice and direction on how to get back on track.

I have two questions regarding my loans, and hope you can address them.

I have three outstanding loans, AES, currently in good standing and paying monthly.

Navient, it has been out of forbearance and they want me to begin paying $1200 + per month, which I am unable to pay that amount, outstanding balance $108,000 (both subsidized and unsubsidized debt. I also have a Federal Loan for $81,200 that will be coming out of forbearance, I have paid a very small amount each month, but they are pressuring me to pay more.

1. I work for the Federal Government in Health Prevention, I read there is a program if you pay your Federal Loans for 10 years (a qualifying payment, which I assume is the full monthly amount required), your loan may be forgiven after 10 years. My question to you, if I rehabilitate these loans into the IBR, which I read in your blog, does that mean I can have the monthly payment reduced and if so, would I still qualify for the loan to be forgiven after 10 years? And two, why do you suggest the IBR versus a PAYE Plan or an ICR Plan. I want to be sure I select the best option for me.

My husband is military and unfortunately I could not find a decent job in the state we were living in, so I had to take a job in another state, we live in two states, he is going on his third deployment shortly and our expenses are high because of us having to maintain two residences, which we rent. I work for the Federal Government in Health Promotion. Any advice would be most welcome.

You have more options with respect to negotiating settlements with Navient. I would prioritize your federal loans first, because they can and will garnish your wages.

I’ve heard about this forgiveness program, too, but I don’t know the details, because it never applied to me. IBR is available for all(?) federal student loans, and lower-income individuals should take advantage of it if possible. I assume IBR can be combined with forgiveness, though I don’t know the details. I would investigate that angle.

Hmm, yes, it appears forgiveness + IBR together is a thing.

-Rian

Following up on a comment I left much earlier. I settled a $30,000 Navient loan for $8,000. My tax bill on the debt was $6,500–$4,500 federal and $2,000 NY State. So in the end I effectively settled for $14,500, saving me $15,500.

Was it worth it? Yes. That’s a huge savings. But don’t forget to consider the tax bill! Especially because it is due in April of the same year you file, unless you request an installment plan (which I did for the federal portion).

I have a question. Do you know how much percentage Navient charged into your loans for defaulting in the first place. I was told when it goes to collections it can be between 18-40% of the total. I am trying to see if it would be worth defaulting to negotiate a settlement.

I seem to recall that they got rid of the charges??? But I can’t be sure. I don’t remember paying any kind of delinquency fees once I entered the 0.01% settlement payoff phase.

-Rian

I am a co co signer. I want to pay this loan. I can’t stand the thought of losing my home. How do I know they accept the amount and really get my name off this.

I just received an email yeaterday offering me a 70% settlement on my $145k student debt. At over $100k my private loan payments are the only delinquent ones because I have been able to use an unemployment deferment for my federal loans, which equal about $45k. Today, I received a letter delivered by UPS from navient titled litigation review, which basically warns me that they are about to send the case to their litigation partner but also states there is still time for me to avoid litigation.

I have not spoken with navient since October of last year, since I made my last payment. I am set to begin an income-driven repayment plan on my federal loans in May, which are also being serviced through navient. That is when I was planning on re-establishing contact with them and re-informing them that I’m still employed only part-time and cannot afford the $700/month, interest-only payment on my private loans. Now, after the last two days of a settlement offer and then a litigation warning I definitely feel like I need to contact them.

Do you have any advice for me in this situation? What should my angle be when I contact them and what should my next moves be (aside from finding a full-time job, i know, i know, believe me) to hopefully recieve an even lower settlement offer?

I have exhausted all of my forbearance so that is not an option.

I really have no idea. I haven’t heard any cases of Navient suing people, so I’m not really sure what to tell you. I would suggest Googling to see if anyone has been sued before. It could be a scare tactic. Or it could be real.

-Rian

This article has really saved my sanity! Thanks for sharing your story. I currently have a 40000 private loan and a 25000 federal loan. I imagine only my private loan can work with negotiating a settlement. I was on the rate reduction program and they refused to restate me on it even though my husband and I are currently unemployed. They stated that i didn’t have any signs of financial struggling on my credit report. When I told him I had no credit cards because all my money is needed for the loan he still held fast that they would not put me back on the rate reduction because I was not eligible- even though my finances have never been worse-this is even after talking to a manager. Then When I went to make my payment they upped my interest rate by 1.5 percent(9.5% total)! So I’ve stopped paying last month. I’ve changed all my contact info so that they can not spam my regular phone and email.

When do you think the optimal time should pass to start negotiating? Ive already payed my original loan time and over again- this is all interest I’ve accumulated. Thanks for this article and any guidance you can provide.

It has been some time since you posted this, but my wife and I, like many of the respondents, are in a similar situation. My questions is this, however: Navient says the Department of Education is not willing to offer settlement amounts, so they are not authorized to do so; were your student loans through the DoE or were they private?

Yes, these were private loans. You can’t negotiate federal loans. -Rian

So your DAD gave you $7,000. What about the rest of us who have absolutely NO ONE to do something like this with? I am just going to suck it up and pay. My plan: Navient is currently the loan manager/collector. I will be negotiating a reduction based on using automatic payments from my checking account. Then, I plan on tackling one loan at a time since they are different amounts, starting with the easiest to pay off which will boost my confidence : ) My loan amount is $120,000, so much for wanting to be an acupuncturist, ergh. Anyway, my minimum will be set to $250 per month, my actual payments that I will be making will be $1800, which my first loan to pay off of $13000 will be paid off within 7 months, then I will go on to the next one that is also $13,000. Etc. Luckily I have a solid job for now and will pay off what I can while I am still employed. If I earn more money, all of that will go toward my payment. Oh, wait, first I am paying off my sister who loaned me $700. Easy Peasy. Good luck everyone, set your plans, suck it up and pay.

—

Reply:

Yes, I borrowed money from my dad, which I paid back. What about other people? I don’t know. Maybe wait longer than I did before engaging Sallie Mae/Navient until you have a down payment to offer? I’m not sure what relevance that has to anything, unless you’re making some weird comment about privilege.

Yeah, I don’t think that’ll work. They won’t negotiate unless you’ve defaulted on your loans. Otherwise they have no incentive to. If it works, though, I’d love to hear about it!

-Rian

I have a navient private student loan, I borrowed 19,000 and they have jacked it up to 51,000. I can’t afford the payments they want and talking to them on the phone is traumatic. I would like to do a settlement but won’t have the money until probably June of next year. I am about a year into default and received a settlement letter but I am not sure how to respond. I won’t take their calls because they are abusive but I just found out after they tried to call me at work they contacted my employer for employment verification. I’m terrified of what they are going to do with it. I sent a $50 payment online in hopes it would buy me some time. I am going through a major financial crisis that has been in progress for 3 years but will likely resolve by next June (fingers crossed). Any recommendations? Suggestions?

The contents of the article, and the comments below articulate my thoughts about letting loans gov into default. It’s already a debt. So what if it goes on your credit report as a default. The loans (and their respective late payments, if any) are already there anyway.

Hi there,

Thanks for your post. I have $60,000 of private student loan debt with Navient. Been paying on it since 2005 (1 year of deferment while unemployed then another 2 years while completing a (much less expensive) Masters degree). My mother is the co-signer, but she passed away earlier this year. I tried reporting her death by emailing them her death certificate, but they required me to send in a paper copy – but I didn’t because I had done more research on it and was afraid my loans would go into auto-forbearance. So, they kind of know, but don’t officially…? Not sure. I am in the process of trying to get her released as a co-signer, but I feel like the chances are slim from what I’ve read about it.

I am now living in Colombia and have no desire to return to the states (I also have dual EU citizenship and plan on having an anchor baby here, so eventually triple citizenship), so I don’t care a thing about my US credit report. I would like to go into forbearance, without even intending to settle. I’m curious if my father would get calls if I did stop paying on this loan. He is not very sympathetic to my cause and thinks I should have gotten a “real” job in order to pay them back. My sisters are of the same mindset and I fear being alienated by my family. I am trying to buy a house and have a baby and not having to pay $500 a month in student loans would really help with that.

Any advice you can give me on the consequences of not paying? Even though my co-signer is dead, could they go after her estate, i.e. my father’s pension? Would they harass him? My sisters?

I already have a Google Voice number so I am not worried about them harassing me.

Thanks for your help,

Nikki

—

Honestly, that’s question for an attorney that specializes in accounting issues. Your dad’s not a co-signer, and his pension isn’t part of your mother’s estate. (If your mom had a pension that passed some monthly amount to your dad, that might be different.)

Dying releases a person from their debt. It’s gone. They can try to collect from family members, but they have no legal claim to any of your family’s money or property. Again, I don’t know about claims to your mom’s estate. That’s question for an attorney.

-Rian

(sorry, I think I meant to say “default” on the loan, not go into forbearance)

I’ve been paying Navient – Sallie Mae before – for ten years with about 6 months of deferment total. $600-900 a month based on the payment plan at the time. I have made only about $14,000 of headway with another $74k still owed. I’m exhausted. I have another chunk due to Mohela and AES – AES will be paid off in three years and Mohela 4 with the PSLF. I’ve only missed one payment to Navient and resolved it. My credit score is 800. Do I just default on Navient, bank the payments while I’m in default and negotiate a settlement? I’d like to get out from under this before I retire. I feel like my whole working life has been paying student loans and I’ve missed a lot of living.

—

If it’s a private loan, that’s what I would do. If it’s a federal loan administered by Navient, you don’t have any negotiating power, unfortunately.

-Rian

Hi Rian,

Nikki here again (wrote Sept 30). Good news! They released my (deceased) mother as cosigner on my private loans. Now my question is, how soon can I default? I’d like to do so immediately. But I’m worried they could reverse their decision to release her? Do you know if this has ever happened? Or, once they remove a co-signer, is it permanent?

Thanks for your help,

Nikki

—-

I’m afraid I don’t know the answers to any of your questions.

-Rian

I just settled my debt with Navient through Northstar Location. I owed $107,000 and I asked them to settle for $8609 which was 10% of the unpaid balance before interest. It was accepted the next day and paid. Just got my settled paid letter from them.

Hi Rian,

I have been banging my head and pulling out my hair trying to figure out how to cut my private student loan debt.

I owe $65k in federal loans which I am consolidating and doing an income drive repayment plan for about $400/month. These are not part of my issue but they are serviced by Navient.

I owe Wells Fargo $85k and my father is a co signer on $12k of that

I owe AES $81k my dad is a co signer on a small part of that balance as well. Should I consolidate those loans where my father is co signer into a separate loan to release him before I go into fault? He is retired and I don’t want him affected by my actions going forward. With the exception of very few payments I have been making all my payments on time and have been lowering my credit card debt but almost all of my credit cards have balances. My payments are almost $2k per month just for student loans and I live in Los Angeles with my parents. I am desperate to move out of my parents and even more desperate to cut down my debt.

My questions are:

In order to salavage my dad’s credit should I get a separate loan to consolidate the $20k he is co signed on before I start defaulting?

2. Will my wages be garnished?

3. I just got a letter stating that all of my AES loans were bought by Navient, will this make settling easier?

4. Have you encountered anyone who has dealt with Wells Fargo to try and settle their student loans?

Thank you for the great and detailed information and your insight on the matter.

—

If it were me, I would do the following in this order:

I have no experience with Wells Fargo, and I can’t answer any of your other questions. Your desire to move out isn’t a priority right now. Your main priority should be saving up a pile of cash to enable the settlement when it’s on the table as a possibility. That unlocks the other things you want in life.

I don’t know if your wages can be garnished. Generally there are rules about what percentage can be taken by garnishment. You might not have enough income to be garnished.

Last but not least: focus on increasing your earning potential. Careers are long stories, and you should be thinking about what you want the next chapter to be. Maybe you can’t jump directly to the thing you want to do, but you can make moves to get closer to it. Make sure you’re doing that. And no, it does NOT mean buying yourself more education. Do it with work experience. Stay the hell out of the classroom unless your employer is paying for it.

-Rian

I am curious if any of the settlements with FMS were on Department of Education Loans? I have a 100k and offered FRS between 5K and 10K and they said “the Department of Education has never taken pennies on the dollar like that”

I am curios if Rian, JK or anyone else believes that statement or should I continue to try to negotiate. FMS is pushing me towards their INCOME BASED REPAYMENT program instead.

Thanks,

Steve

—

You can only settle private loans. Uncle Sam doesn’t negotiate.

-Rian

Rian,

Thank you so much for getting back to me. After reading your experience with your loans it gave me a sense of hope that I had not felt before. The steps you mention are exactly what I intend to do, I just wasn’t sure if I should consult or hire a lawyer since Wells Fargo tends to be very unforgiving. I have a feeling some of my WF loans are not legitimate but I have no idea how to prove it or where to start looking; they are also the ones who worry me most because they seem most likely to sue me.

I work in the field of architecture and I recently got a small raise so, after reading your post and doing some calculations I determined that if I follow your advice, I can get out of credit card debt and save at least $10k by the end of this year. I am not sure if that will be enough to settle with AES but it will be in a savings account as a back up. I am trying to get licensed as an architect to earn more money but that takes time and money and it’s the money part that has been holding me back from taking all of my tests.

I live in California where the statue of limitations on collecting a debt is 4 years but if I follow your steps, I can save up enough to try and settle in 2 years. Anyhow, I really appreciate that you got back to me and that you so clearly documented your experience. Thank you for being so thorough.

Has Navient tried to contact you about this page in an attempt to pull it down? Also, thanks for sharing your story, this gives me hope.

—

No they haven’t.

-Rian

Hey All,

After years of ignoring/not being able to pay my private loans I have settled all four of my private loans as of Jan 2018. I took this in stages as the process is difficult and takes funds in cash and negotiations.

-National Collegiate Trust will settle for about 20% of the original note; please note if you have additional loans with them and settle one–they will pursue you aggressively b/c they know you can get the funds.

-Sallie Mae -will also settle for less than 20%

-Originally I owed $40,000 but with fees and 5+ years of non payment I was being stalked for $75-80,000.

-Settled all four accounts for less than $25,000 with my parents help.

-If you can line up additional support, Credit Union loan or personal loan to accomplish this it can be done and start your negotiations LOW (ie, I was being billed for $55,000 and started at $5,000 and we went back and forth and settled for $7,500.

You can do this!!!

I have private student loan with AES total 70,000 . I filed chapter 13, 10 years ago. I made payment on this loan until 2009,when they sent letter stating the loan had been sold .When I contacted AES they stated that they could not tell me anything due to my bankruptcy. I thought I would get something in mail to continue the payment plan, but I never did. This past Feb 2018I received a call from collection company . offering to settle for 32,000( which I do not have).I request all documentation to ensure I owed the loan as per my ( bankruptcy attorney). They contacted my attorney, stated that they are unable to find that paper work. Should I make low ball offer or wait and see if they continue calling .

—

If they can’t verify that they own the loan, then you don’t have to pay at all. I would sit tight; your “settlement” might end up being $0.

Rian-

great column. Quick facts: I have about $115k in student loan debt serviced by Navient.

75k is Federal loans which I consolidated. the other $40k are private loans. The privates have 14 more years of payments. the Fed loans have 24 years of payments.

I earn decent money at about $200k/year, and my total loan payment now is about $1000/month.

I recently came out of a chapter 13 BK so my credit is crap right now… so if I were to start defaulting on the privates – how long would it take them to offer me a settlement? would they offer me one? My credit score can’t get hurt much more and if I could wipe out the $40k… I could use the money to pay off the other $75k much faster

could they garnish my wages? I work for the government, so it would be easy for them to try if they wanted to. I also work for a qualifying agency, so that if I make on time payments for 10 years I should be able to get the rest of my fed loans forgiven.

thoughts?

—

Yeah, hmm. So I defaulted in the middle of (I think) 2010, and then hid from the phone calls until mid-2011 when I was meaningfully employed. So I think it would be about a year until they offered you a settlement. Keep in mind that the economy was in much worse shape then than it is now, which may have some effect on settlement offers or the lack thereof.

So I think my hand-wavy answer is “Probably about a year, if they offer you one at all”. So far as I know, they don’t have access to your income information. So far as I know.

I don’t know if your wages can be garnished for a private student loan without a judgement by a judge. I can’t answer that question. Certainly federal loans can be garnished more easily.

Thanks for your post Rian! Your post gives us hope! I do have a question though. We owe about 66k to Navient, behind our payments (they are threatening a charge off) but long story short, we may be in a position to settle our debt (due to some inheritance).

Do you have any specific tips on how to start the conversation with Navient? I have settled credit card debt in the past, but Navient is just really intimidating for me. I’m just really concerned that we will agree on a settlement amount, we will pay it, and then they will somehow “lose” the settlement information. I realize we need to get everything in writing but I just don’t trust Navient at all. Is this something I can really tackle on my own or do you recommend a professional?

Hello , i found your post online and i know people who have settled 85,000 with Navient to an amount of 31,000 and are still negotiating . A close acquaintance of mines stated that they went 4 yrs with out paying , Ive only been in default for 6 months and Navient just sent me a cost of default letter . I was wondering if you ever received a letter for you to appear in court . I’m trying to get a timeline of how long do i actually have to get my feet under me my student loan debt is 250k all Navient private student loans

How do you get through to someone in order to negotiate a payoff?

Great article! My question is how you were able to speak with someone about negotiating a payoff. Any time I’ve spoken with someone from Navient, they only want to discuss my income and set up a payment plan. Of course, negotiating isn’t exactly my strong suit either, but I haven’t been able to get beyond the point of discussing a payoff. Is there a specific department you have to ask for? Thank you.

Hi Chad,

Glad you can get out of it. What was happened to your credit report after you settled? Would the debt completely wiped off from it?

Thanks,

Jaime

Hey Rian,

Thank you for all your work. You have no idea how much help you are to people stuck in these situations. I have a 10k loan from Sallie Mae/Navient that has now accrued interest and is about 20k now. I got a call the other day from a woman who worked for Navient’s Recovery dept. Long story short, she tried to get me to settle the loan for $14,500 and said she could release my co-signer for $8000. When I told her I couldn’t pay either of those amounts she emailed me over a list of lenders that she suggested I contacted to borrow from in order to get the money to pay. I tried to explain that my credit is shit thanks to these unpaid loans and I can’t get approved for the lenders. She’s waiting for my call on Monday and says that I need to show proof of me getting declined before she can do anything else to help. Please help!

How long after you settled with Navient, did it take for your accounts to be updated and for you to get the official “account settled†letter

I found this interesting. I have $227k in loan debt. About $135k is private. I have a cosigner so things may be a bit different but I have defaulted as of the end of this month. I have 5 months forbearance left to push back the “litigation proceedings” they have threatened with to attempt to file suit to garnish my wages. I’ve never had someone get sued by Navient, just that their loans were outsourced to collections and ended up settling on a certain figure. It’s been about 9 months of dodging calls. We will see what happens, I’m just trying to stay afloat as a single mom paying my federal loans. I’d love for an outcome like yours, thank you.

How did Sallie Mae not garnish your wages in the time period you did not pay?

—

I didn’t have income to garnish. (I also think it was less common then? I don’t know what’s normal in 2019.)

-Rian

Thank you for your information. My son have been trying to settle his student loans with Sallie Mae. However, he request to receive documentation of the amount that Sallie Mae will settle for. His grandfather was going to give him the money to settle if he can get it in writing. Sallie Mae will not provide this information and will not allow my any options. I spoke with an attorney, and she want to my son to file for bankruptcy and I do not feel that this is not smart to do, especially if my son grandfather will give him the money to settle his student loans. At the present time my son is not working and is very frustrated because he has sent several letters to Sallie Mae requesting assistance to receive other payment options. I am waiting and hoping that Sallie Mae will send documentation, so that my dad can get the money to settle my son student loans. Please advise. Thank you.

Sarah

—

Sallie Mae/Navient would not give me documentation, either, which I outlined in this post.

You need a new attorney. One that knows that student loans are not dischargeable in bankruptcy. Honestly, this is common knowledge. I don’t know why your attorney would even bring it up, because it’s just not an option.

If it were me, I would try to convince granddad that the option is real. If you can, record the conversation. 39 states allow you to record conversations without telling the other party.

http://www.dmlp.org/legal-guide/recording-phone-calls-and-conversations

If you can get the rep telling you verbally what the offer is, you have a case later if they try to change the terms of the deal.

-Rian

If I go long enough without paying won’t Navient write it off and I won’t have to pay anything?

Thank you so much for sharing your success story. I have two loans with Sallie Mae. One was for over 10k and my brother in law co-signed it. The other one is about 18k now. When I needed to start making payments I couldn’t bc I wasn’t employed and it affected my in law’s credit score, bad. Once I started working I focused on getting the co-signed loan up to date — especially since it was affecting my in law.

Once I get this loan out the way, how should I go about trying to handle the 18k loan? This one isn’t co-signed. I still have a considerable amount of government loans but those are on deferment as of now.

Thanks so much for this! It was SO helpful. I currently owe about $41,500 to navient but the loan servicer is allied interstate llc. They have sent me several settlement options ranging from 9k to, most recently, 12k. I think I can manage about 9k within the next few months but just not immediately. The last representative asked if I could come up with a plan where I give the money overtime, like in $3,000 installments over the course of 3 months for example. He said that’s a good way he could to pitch to navient in order for them agree on the settlement- even if not paid today in one lump sum. Do you think that’s a process worth trusting? I’m nervous that if I agree to that and start paying them, they’ll turn back on their word, take my money and insist on me paying the rest of the $41,500 instead of just the agreed upon settlement amount. Or would it be illegal for them to do something like that- especially with a written payment agreement? Also, is it ok to get that agreement in writing via email or is it a must that it be mailed to me? Thanks SO much for your help and thanks for sharing!