March 22, 2015

This article is for people who have defaulted on their Sallie Mae/Navient student loans. If you haven’t defaulted, or if you’re paying traditional subsidized or unsubsidized federal loans, this won’t work for you. For those of you that ARE in this position, this post is for you. You can get your life back.

I’m sharing all of my actual numbers, because it makes the conversation more useful.

Managing the chaos

Like many people, I was unemployed in 2009-2010. I had the bad fortune of graduating in the middle of the recession, and had quite a bit of difficulty finding a “big kid” job, i.e. one that would let me pay my bills–including my student loans. Also like many people who are struggling with debt they can’t pay, I was plagued by phone calls, and they were universally unproductive, because stones don’t have much blood to give. The first step to getting your feet under you is to create mental space, and the biggest thing is to stop the unwanted calls.

In addition to sending letters, I did this:

- Get a Google Voice number

- Log into your delinquent accounts, and use the Google Voice number as your only phone number

- Don’t answer numbers you don’t recognize

- Take down each collection agency’s contact information (phone number, debt they’re collecting on, etc.) when they leave you a voicemail

- Block each caller one by one

This builds a strategic rolodex for tackling your debts when you’ve got your feet under you. If getting back on your feet takes a while–it took me 2 years–you’ll notice that debt gets resold fairly often, and as it gets resold, the settlement offers get better and better. This is particularly true for unsecured, consumer debt, and less true with student debt.

Negotiating with Sallie Mae/Navient and FMS

Sallie Mae stops trying to collect debts themselves fairly quickly, and they tend to outsource this to other agencies. Unlike consumer debt, Sallie Mae does not sell the debt to the servicing organization. Instead they retain ownership of the debt, as well as the terms and conditions under which that debt may be settled. (In fact, if you try to call Sallie Mae directly, you will be redirected to the servicing agency without ever having talked to a human being.) The debt collector is just a proxy, but they’re the ones you’ll be dealing with.

My debt was serviced by an organization called FMS. You can Google them; there are many horror stories, but my experience was pretty good, barring a few incidents. I had settled a couple of smaller credit card debts to this point, so I made sure to unblock their phone number only when I had a small lump of money available to make a down payment. I knew I wasn’t going to be able to discuss a full settlement, but maybe I could do something to move the needle in the right direction. This ended up being a good move, though the benefits weren’t obvious until much later.

Default settlements

I’m going to use the term “default settlement” below. I don’t know for sure, but I believe that Sallie Mae’s proxies are authorized to offer some percentage (65-70% or so) as a settlement amount, without phoning the Sallie Mae mothership. The reason I believe this is true, is because they would periodically offer me settlements on the spot which didn’t require them to phone home. This was in contrast to my counteroffers which required a ~24-48 hour turnaround time where they had to talk to someone with more authority.

The reduced-interest plan

June 2011 balance: $144,586.

I brought my account up to date on July 25, 2011 with a $1,493.38 payment, and set up a recurring payment every two weeks for $372.56. This was their “reduced interest plan”, where the interest rate dropped to 0.01%. There was no discussion of a settlement at this point that I can recall. If there had been, it would have been WAY more money than I had, so it didn’t matter.

I made bi-weekly payments from July 2011 to May 2012.

The first settlement offer: the first $80K

In May 2012, I got a phone call from FMS to re-up my recurring payments. (They can only schedule 12 at a time.) At this time, the rep I had been dealing with all along offered me a settlement that was still too large for me to take advantage of in one shot. I told her as much, and if I recall correctly, she conferred with her manager and the Sallie Mae mothership, and they made me a counter-offer: an $80,000 reduction if I:

- Made a $7000 down payment by the end of the month

- Paid $800/month for 45 months

- At the 0.01% interest rate

This dropped the loan term from 155 months to 45 months, a 9+ year reduction. BUT, if I broke the terms, the full balance came back at the original interest rate, minus whatever I’d paid. I went for it, because saving $80,000 and 9 years was too good to leave on the table.

- Settlement starting balance: $45,375

- Made the $7000 down-payment (with my dad’s help) in May 2012, which

- Reduced the amount left to pay to $36,375 (or so I thought, more on that below)

I set up a $400 recurring payment every 2 weeks, including months with 3 weeks to ensure I’d make the deadline with some headroom.

A bump in the road

Unfortunately, FMS wouldn’t send me paperwork stating the terms of the settlement, which (as I suspected) came back to bite me. I also hadn’t recorded our phone conversations, because until this point, there was no reason to think that I would need to.

December 2013 rolled around, and I received a phone call telling me that I was almost out of time, and that I owed like $45,442 by ~February 2014, which didn’t sound right. Unfortunately, I was dealing with a new representative, and she couldn’t decipher the notes of the previous representative. It was my notes against theirs… and when you’re in this position, the other party holds all the cards; you’re just along for the ride, hoping they don’t fuck anything up too badly. (That said, I’m very confident that my notes were more accurate. Not that it mattered then, and I can’t imagine it would have mattered in a courtroom.)

There was about a week of back-and-forth, but the takeaway was that I owed the $45.4K, but that the terms were extended until September 20, 2018. That was a big relief–there was no way my pre-wife and I could have come up with the money in that time.

I made sure to record that conversation should things go awry again. Check the laws in your state… my state is a two-party state which means that I needed the rep’s permission to record the conversation.

The final $20K

Because FMS can’t schedule more than 12 payments at a time, I end up talking to them about once a year. While re-upping my payments for this year, the rep mentioned that for whatever reason, Sallie Mae was accepting settlements “for pennies on the dollar this month”. That’s just a figure of speech, so I didn’t know if that was literally pennies or what, but she asked if I was interested in seeing if they would re-negotiate the settlement, because I’d basically paid $35K already, and was a model citizen. Of course I said yes, and they offered me their default settlement of $24K on the $35K owed on the spot, which is 68 cents on the dollar. I told them I couldn’t do more than $10K–a true statement–fully expecting a counteroffer for somewhere between $10-20K, whereupon we’d have to borrow some money from my wife’s parents. They said they’d have to call SLMA to see if they’d approve it.

The next morning, I got a call back: Sallie Mae had approved the $10K for the remaining $35K. The rep was shocked. The manager was shocked. They told me no one in the office had thought it would go through, which I believe. I get the feeling I’m going to be an office legend for the foreseeable future.

Recap

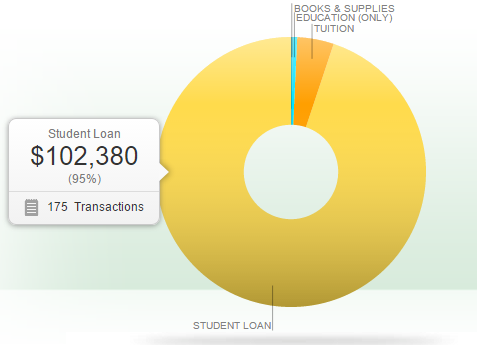

- $144,586 original balance

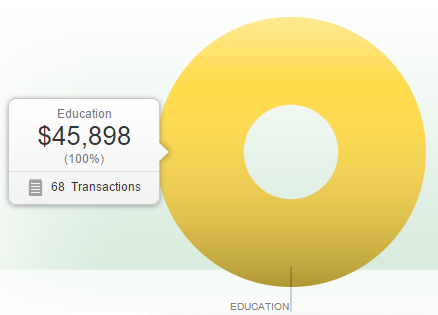

- $45,898 paid over 3.25 years

- $98,688 saved

- 68% discount (or 32 cents on the dollar) when all was said and done

FMS payments

Here’s a Google spreadsheet that shows all the debits over that time. Alternatively, you can download the Excel version.

Total student loans paid during this time

I have more traditional subsidized and unsubsidized student loans that actually had interest rates, so I focused on overpaying those during this time.

Conclusions and tax implications

Once you wrap up your settlement, you’ll have taxes to pay. In my case, my income tax burden for 2015 is now my salary + $98,600, which is… a lot. Depending on where you are financially, you may be able to reduce the canceled debt “income” by whatever your net worth is, if it’s negative by filing a Form 982. To determine if this is available to you, you can fill out the worksheet on page 8 of this IRS form. If the sum you come up with is negative, you can subtract that amount from your paper “income”. (I suggest you talk to an accountant if this applies to you, though.)

Other options include maxing our your pre-tax retirement contributions (401k/403b), and/or using your FSA plan to do something expensive like getting the LASIK you always wanted. Unfortunately, doing this latter thing requires knowledge ahead of time that you’ll be settling during this particular FSA year.

Otherwise you’ll want to adjust your tax withholding, because you’ll pay an underpayment penalty in addition to the tax on this “income” if you don’t pay enough tax throughout the year.

So I settled on a settlement saving my wife and I about $100,000 and ten years. This will let us buy a house and start a family years earlier than we had thought we’d be able to. I think my situation may be unusual, but I don’t believe for a moment that I am a beautiful and unique snowflake. Three and a half years ago, my Sallie Mae situation seemed hopeless, and now… it’s over. It took a lot of hard work, and an unwavering focus to get here, but it can be done.

If I can do it, so can others.

Addendum – June 1, 2015

I wrote this article back on March 22 — 3.5 months ago. I had expected to be able to publish this much earlier, when I got the statement that our business was concluded. During this period, a few things happened

- I never received the paperwork stating that I had fulfilled my side of the deal

- Sallie Mae/Navient and FMS parted ways as business partners, which made it harder for me to get information from either one of them

- I had to fight with Sallie Mae/Navient in an attempt to get them to send me paperwork. They never did. When I talked to them on the phone, they stopped allowing me to record our conversations for some reason

Until today, I had no idea whether this was really done or not. I pull my credit report every year, and was expecting to wait until the summer in order to see if the status of my Sallie Mae/Navient loans were changed. But I bought a new car last week, and part of the financing involved the dealership pulling my credit report, which I was able to take a picture of. It indicated that the loans were settled for less than the balanced owed.

I feel reasonably confident that this is the end. Finally.

Leave a comment

- If it’s your first comment on my blog, it will probably go into the moderation queue. Don’t worry, it’s not lost; I just need to approve it. It could be a few minutes, hours, or days. I will get to it, though.

- Try to explain how your situation is different than people that have commented before you. Questions that amount to “I owe money, but can’t afford payments. What should I do?” aren’t constructive.

- I will assume all questions are about private loans only. Federal loans are a completely different kettle of fish.

1099-C update – Feb 2, 2016

I received ten(!) 1099-C forms from Navient on Jan 28. When I reported them on my taxes, I collapsed them down into a single entry for the total amount. I also filled out insolvency Form 982. I was deeply insolvent at the time of the discharge, so instead of paying income tax on an extra $115,282, I only paid income tax on $32,313, because I was underwater by $82,969.

I used TaxAct, which made the process very straightforward. I collapsed the ten forms into a single line item because TaxAct cannot handle more than five 1099-C forms, and their Form 982 worksheet can only be applied against a single line item. We’ll see if the IRS complains. (I don’t know why they would:- the numbers are identical whether they’re reported across ten line items or one.)

Settlement amounts from other readers

- $30K for $8K or 27 cents on the dollar – Jan 2016.

- Update Feb 2017: his tax bill was $6,500–$4,500 federal / $2,000 state

- JKÂ owed $107,000 and I asked them to settle for $8609 which was 10% of the unpaid balance before interest. It was accepted the next day and paid.

I am having the same issue, my loans just now came to be $1031 a month which i cannot afford. They will not work with me, they said they MAY be able to reduce it to $736 a month. Still i cannot afford to pay it. There is a co-signer on my loans who i do not speak to. Will this system work if i did the same thing? Just trying to get my feet on the ground.

I had a cosigner as well. They called her repeatedly when I wasn’t paying, but she just ignored calls that she didn’t recognize. Having a cosigner did not affect my ability to settle.

Thanks for the clarification and quick reply. I can’t tell you how much i appreciated reading your blog and you spelling everything out from your situation. Its nerve racking to think that companies do this. I was on the phone with them for 2 hours and they still don’t know if they can do the $736/mth which is insanely high, and i’ll have to wait a week. Defaulting seems to be the only way unfortunately to get anyone to do anything. I am very smart when it comes to credit and i do know the statues of limitation laws as well as the every 12 month renegotiate the terms rule with collection agencies. It sucks that i may have to do this. Did your late payments and default adversely affect your co signer’s credit as well? I would assume so. Thanks so much for your insight!

My cosigner went bankrupt before I defaulted, so her credit was very bad anyway. (Medical bankruptcy.) I don’t know if it made it worse, but I find it hard to believe that it would. Unfortunately, I can’t answer your question meaningfully, but I suspect Google might have the answer if you search for something along the lines of “will defaulting affect cosigners credit” or something like that.

Thanks for all your advice :)

Good luck, and keep on truckin’. There’s a light at the end of the tunnel, even if you can’t see around the bend, yet.

Stop paying them. It’s scary at first, but it’s a valid option. (Change your phone number, or get a google voice number so you can block numbers easily, and change your contact information to that number.) Get your feet underneath you, get some financial security before re-engaging them.

Maybe by the time you have some stability, they’ll be ready to offer you a settlement. That’s what I did.

No, of course you wouldn’t go to jail. We don’t put people in jail for not paying back their loans (unless it’s a fine — see the John Oliver segment on fines and their impact on poor people). Anyway, the worst that happens is that they call you multiple times per day, which is why I suggested changing your phone number, or better yet getting a Google Voice number so you can block them (and then unblock them when you’re in a position to have a more productive conversation).

In theory they could start legal proceedings against you–which sounds scary–but the worst that would happen is that your wages might be garnished. That doesn’t usually happen for a year or more, and they never started for me, and I was delinquent for more than a year on my private loans. Obviously if you have little to no income, it won’t be garnished; there are pretty strict rules in place to protect people from being destitute as a result of garnishment.

Usually the lender will take one of two routes: attempting to get a settlement, or garnishment. The Federal government usually opts to try to garnish, but on private loans, the preferred method is settlement, and you have many, many opportunities to settle. Ironically the settlement offers tend to be more favorable to you the longer you go without engaging them.

You have to remember that collecting loan money isn’t a moral question for them: it’s a matter of balancing the probability of getting paid (at all). The longer you go without paying, the lower that probability gets as an input into their will-we-get-paid equation. To them, it’s just business. And that’s exactly how you should treat it when you engage them: as a business transaction. (I.e. don’t fall for the games that reps will play where they try to make you feel like a bad person. You aren’t a bad person when you negotiate your debts — you’re just being shrewd, which is what their business would do if it were in the position that you are.)

Hey there,

Thanks a lot for your post, it’s really usefull for me right now. I’m at the same position but have some different things. I took the private loan as international student at SallieMAe/NAvient and got crazy interest rate 11% Despite of this I’ve paid back $70K including loan and interest for 5 years. One year ago I stoped paying and answering on their emails. One week ago I got the call from them and after this they sent me the settlement to pay just $50K Since the interest rate was so huge the outstanding balance is $110K now. Anyway I can’t pay so much money. Can you give me some advice based on your experience?

Thanks in advance

Who called you? Sallie Mae/Navient or a collections agency working on their behalf? If Sallie Mae, you probably need to wait until they give it to one of their contracted collections agencies. If it was a collection agency, you can propose an alternative settlement. (Collections agencies are incentivized to get people to settle. In my case, they were surprisingly good to work with. Not all of them are.)

Alternative settlements can be one big lump sum up front (or within some fixed timeframe like a month) if you have the money. Or they might offer you what they called the reduced interest plan + lower settlement amount, which is the path I ended up on. This is where you pay a fixed amount every month (or whatever), and you stop paying after some number of payments, and then the loan gets marked as “settled for less than amount paid” on your credit report.

Accepting the reduced interest + settlement amount doesn’t mean you can’t renegotiate again later. For example, if you build up, say, a $15K lump of money while you’re making your reduced interest payments, and you still have $40K left to pay over the next five years. There’s nothing stopping you from calling them and offering them $10K to settle that remaining $40K on the spot. Collections agencies are incentivized to try to make that deal happen, because they get paid by closing out delinquent loans. In this example, you have a $5K buffer with which to handle a counteroffer if they make one.

If it’s SLMA/Navient calling you, they haven’t gotten desperate enough to outsource the problem, which means they’re still optimistic that they can get the full amount out of you. You might need to wait a little longer.

Hello!

I came across your blog as I have been frantically searching the Internet in need of help with Navient private student loans taken out at a for-profit college.

Here are the quick facts:

-I owe $115,000

-I have been paying on time (paid $20,000 in interest alone last year) but lost my second job and can no longer pay the minimum so I will miss payments starting this next month…

-I live in SC where no wage garnishment is allowed for consumer debts (consumer friendly laws here).

Few questions:

-Looks like you had a job that made you enough money that could help you save for a potential settlement. Did you save the money yourself from the wages you were earning for the potential settlement ($10,000)? Or did you have to borrow that too?

-Did you ever have to send them proof of your monthly income and bills to show them what you “really” could pay? Was the amount that you agreed upon something that fit within your budget or something that was just too good of an offer to say no to?

-Did you ever consider hiring a lawyer to help you? If you did not, looking back on what you did, would you have hired one?

-Anything else you would suggest to people in your similar position?

I appreciate your blog post and hope you can help another desperate person!

I saved the money myself over a period of time. This was a four-year battle, so very roughly it went something like this: settled some consumer loans (credit cards) that had balances that were comparatively small compared to my student loans. Settle some smaller student loans (mostly less than $5K). I didn’t go in order by loan type; I went in order by loan size: smallest to largest until my loans under $10K were all settled. (The ones I could trace back to a source, anyway. It gets hard to find who’s servicing your loan a year or two after default, because the notes get sold to collectors who sell it to other collectors, etc.)

I engaged Sallie Mae a few months after I started working. I was very conservative in what I told them I could pay per month. I carved out a healthy amount of space for building an e-fund, having money to travel, and Roth IRA contributions.

My life wasn’t defined by my student loans during this time: I moved into my own place, met my wife, got married, changed cars twice, went on vacations, started contributing to a 401k, etc. In the beginning I kept my life very simple while I built out a little financial breathing space, and didn’t move out or start dating until I had the absolute basics taken care of. I kept a zero debt balance (except for car loans) during this time, too.

No, that never happened. They offered terms associated with the reduced interest settlement (from my blog post above) that worked for me financially from day 1. With a $180K balance, I think it was $600/mo. If that had been too much, I don’t know if they would have done some analysis of my finances and tried to come up with something they thought would be reasonable. If that had occurred, I think I would have said “No thanks,” and let it ride a little longer — loan companies don’t know you or your life, so any amount they would have come up with would have been favorable to them, not livable for you. Frankly I would rather have taken my chances in court.

I didn’t consider hiring a lawyer at the beginning, no. It wasn’t until they started jerking me around with being able to record phone calls that I wondered if I might have been better off if I had. Having an attorney work on my behalf might have changed the power asymmetry somewhat. (Not in the eyes of the law, but in how loan servicers treat you.) Had I ever gone to court, I suspect the lawyer would have kept better (read: legally-admissable) records than I did. Because it was me taking notes half the time, without an audio record, it would have been my word against theirs. (Their record keeping was shit, btw. Immensely frustrating, especially with the rate of representative turnover they experienced: it was all note-based, and each rep had to decypher what the reps before them had written.)

Your life is more important than the money you owe. Don’t let it consume you. If the calls are too much, make space in your life by changing your number, or blocking their calls. You can’t get your feet under you if you are constantly stressed, having unproductive phone calls with people who don’t give a shit about you, and treat you as though you are subhuman. If I hadn’t blocked dozens of numbers, I would never have had the space to have the mental quietude required to build the skills I needed to get a high-paying job. I would have been stuck on the emotional and financial hamster wheel. Sallie Mae and I both benefited from my actions.

If there’s going to be any kind of legal action against you, you will receive notice in writing, and you’ll have ample time to respond before the action begins.

I do this because I think it’s an important dialog. You aren’t alone, and I want this to be a judgement-free space. Hopefully with eventually-decent Google rankings.

Thank you for the quick reply!

I think your advice about not letting the debt consume you is much needed for people in our position. I was feeling that stress and unhappiness.

Hopefully I can come back to your blog in a few years with a story that has similar ending as yours. Thank you again!

Rian I found you by looking into the Sallie Mae SCRA Settlement With the U.S. Department of Justice.

I hoped that I would be included but after calling I learned that this was only available to those who served in the military .

I am a Federal Employee and will get the Sub and Unsub loans forgiven after 120 on lime payments. $45K (I don’t mind this payment because it is very reasonable with my income)

I am on a reduced payment plan now that is coming to an end and here comes the anxiety, the ulcers, the headaches, the stress, the pleading and the frustration of trying to get them to allow me to pay something reasonable for the next 12 months. What hurts me is I cannot allow them to default because of the position I hold:( so I am not sure if this will work for me. I keep praying for a relief on these $82,000 in private loans now that I am 31 it looks like I will carry these loans into my 60’s!!!!

I will try the negation and don’t mind coming up with large amounts but with them not in default I don’t suspect they will be willing to work with me. I am thankful for my 3 degrees including a Masters and I don’t mind paying what I owe. It just seems light at the end of the tunnel is sooooo far out of reach with the variable interest rates. This plague is something that weighs on me daily.

Prayerfully I will have a positive story to share one day.

I appreciate you sharing your story – even if mine doesn’t turn out like yours.

I don’t know what position you have in the government, but I doubt you’ll be fired for defaulting on your loans. You might not be hired if you were unemployed (another terrible practice), but I doubt you’ll be fired. How would they know what the situation with your loans is, unless they pull a credit report?

Just pay what you can afford to pay on a monthly basis. If the minimum is $500/mo, but you can only afford $200, then pay the $200. A lender shouldn’t rule your life.

Hey Rian,

Thank you for posting about your loan negotiation with Sallie Mae. It has been very helpful. I had a few questions and thought you may know.

I currently owe Sallie Mae $76,000. I had made about 12 payments until I got unemployed. Since, then it has been about 5 months since I haven’t paid them. They have called me directly several times asking to pay. The payments I have made, barely helped my principal amount, as my interest rate is ridiculously high (12%). I asked for a longer forbearance period and I was denied that. This is my current situation!

A few questions:

– My loan will continue in default for atleast another few months until I land a job. Will this be enough for a negotiation?

– You mention a third party will reach out to you for negotiation after the loan isn’t being paid. How long after do they reach out typically?

I know that I will be damaging my credit by not paying my loans. But, I just want the best possible solution to negotiate my loans down. And of course the lower the payments the better.

I look forward to hearing from you.

Thanks,

Dolly Patel

I am having issues with my student loans. They were merged with my ex husband ‘s. They were on differment while he was on disability, then we got divorced and the judge divided the loan as was our pre marital debt. Navient is refusing to obey the court order. I have tried to defer again as they said I could but since my ex is not allowed to have contact with me (court order) and Navient won’t do anything without him. I can not afford the payments and am on state support. Any ideas?

It’s the court’s job to compel Sallie Mae/Navient to comply with its judgement, not yours. In this case, it sounds like you need a lawyer, not the advice of a person on the internet.

Thank you so much for posting this, I don’t see much out there that gives detailed like you did.

I owe about $100k to Navient.

For now, I have interest only for the next 2 years. Obviously, I feel the noose around my neck as I get closer to when I have to pay it – I work in non-profit so pay raises are pretty non-existent. Looking for all ways to bring in additional income, the sheer panic that I feel sometimes – can be consuming.

I am glad to read your post, gives me some hope and insight of how it can get if I can no longer pay. I don’t want to discharge it, but they don’t want to lower the interest rate and no one would allow me to refinance – since I hold so much debt.

The thought of going completely ‘no payment’ scares me – but I feel later down the line, that might have to happen – I have my kids to worry about and refuse to let them starve – as long as I am paying, they won’t have a reason to try and work with me.

It’s just so sad that there are so many of us out here that are struggling, when all we wanted was an education to make our lives better… which sort of back fired.

Hi Rian.

Yea like more and more people are writing to you I see. I am in the same boat. I have told them that I am unable to pay the $300.00+ per month. I am right now $2100.00 behind because I missed one payment. They told me if I miss one payment because of my prior commitment they were going to automatically put me back on the regular repayment plan.

I told those idiots that I wasn’t working. I have run out of unemployment. I am behind in my rent by two months…..etc. I started a job three weeks later and I have been cut off and on. Losing about 8 hours to 10 hours per week. I am looking for another job….sigh….Anyway in October they said they were going to start collection processes. How long does this take? Should I make some kind of payment on my loan in the meantime? Isn’t it correct if you make some kind of payment and you are trying that the will still call and ask for more money? And one more question. How long does it take for them to start their Gestapo threats? Thanks. A quick response would be helpful.

Short version: going to collections works to your favor, so use it.

Assuming “they” is Sallie Mae/Navient… I have no idea. They may or may not have sent me paperwork telling me it was going to collections, but I wasn’t paying attention to student loans at that point. I was focused on finding a job, since I was unemployed. Student loans were just noise that I tried to minimize while I focused on fixing the real problem, which was unemployment.

Anyway, “going to collections” sounds really ominous, which is why lenders say it. Know what happens when your account “goes to collections”? Another organization takes over making the phone calls. Things that don’t happen when you go to collections:

It really just means some other organization takes over the job of hassling you at regular intervals, and your credit takes a hit. Know what happens when your credit takes a hit? It gets harder to borrow money for stuff. (That’s about it, unless you apply for a job that requires a credit check, which should be outlawed except in some very specific circumstances.)

Anyway, going to collections actually increases the leverage you have. Going to collections is stage 1 of them giving up. You are statistically less likely to be willing or able to pay back what you borrowed, which puts you more in the driver’s seat than you are right now. Collections agencies are incentivized to negotiate with you because they are compensated on resolving delinquent accounts. So they’re more willing to play ball.

Focus on getting your life together. Get your feet under you, and then engage with whomever is trying to collect. At that point you’ll be in a stronger position: you’ll have some money, and the statistical likelihood of you paying back your debt will (actuarially) be much less than it is today, which is further incentive for them to accept terms that are more favorable to you.

If I default on the loan, does the new collection agency change the interest rate on the loan or tack on a lot of new fees? Also, once I stop paying, how long does it take to be turned over to a collection agency?

Sometimes, but all of those things are negotiable. Most people don’t know that, though, or are afraid to try negotiating. One of the mindsets that’s hard to throw away is that you have no power. Unlike going to Wal-Mart, you can negotiate everything from the interest rate to the monthly payments to a lower principal balance.

As with everything… it depends. Could be six months, could be longer. Like all organizations, lenders are bureaucracies. Sometimes they are more efficient than others. If the economy is good like it is now, there are probably fewer people in default than there were 4 years ago, so they might be more efficient at moving you to collections. (Which is better for you if the loans are private, because then you can negotiate.)

I need your opinion on something.

I came into contact with Student Loans of America discussing the consolidation of federal loans, but since I have a private loan with Navient, I was forwarded to a law firm that deals with “eliminating” these loans by settling with them. I would pay a monthly fee for 4 or 5 years, which would act as the retainer for the law firm (Knepper and Johanson).

My main concern is my credit as I’ve always made my payments despite the struggle in the beginning as well as the authenticity of this settlement. I’m not sure if it’s legit. What’s your take?

Wonderful story. My original loan was about $45K. I didn’t have a job for a couple of years and it blew up to $108K due to so called interest. I had been paying about $200 a month from 2013 to 2015 to halt the interest. Earlier this year, I had a settlement offer from Sallie Mae (Navient) for $17K. I borrowed the money from family and paid it off. But now I am really worried about the tax implications/consequences. I read your bit about tax implications but I am still confused. Is there a way to estimate how much tax I would owe? Who do I talk to? Thanks for your help.

P.S. I was planning on doing LASIK later on this year.

I’ve never heard of such a thing. If I had to guess, though, I bet they’re approaching Navient with a settlement offer, and taking a cut. So if they get Navient to settle for $10K, they might charge you $12K, and take the $2K as profit. But I really have no idea about the legitimacy or whether it’s worth doing.

In theory you could approach Navient, and get the $10K offer yourself, and not pay a fee. In practice, though, sometimes those law firms have back door channels that they work through that you don’t have access to. I would Google around for that specific firm and their offer.

I don’t know. The 1099-C income is the value that they’ve written off, so the question is what they wrote off. Did they write off the principal balance, or the principal balance + the fees? I really have NO idea what the answer to that question is. I suspect it’s the $45K – $17K = $28K in “income”, but I’d put my certainty at 50-50. And of course they won’t tell you if you call and ask.

Hi. I have two private loans in collection. One for $58K I just settled for $15K. The other’s for over $5K that’s in collections with CCA & I’ve been paying them $10/month. Fri., I spoke with someone & he said I owed a little over $5K. Yesterday I spoke to someone there (the guy handling my case – most of them are very nasty) & gave me a different figure that was about $200 more than the one I got fri.. I said I wanted to settle. At first, he said it could be taken from my tax refund, but I told him I wouldn’t get a tax refund. He asked if I had filed taxes & I said yes, which I shouldn’t have (I just filed my taxes two days ago). I offered $500 & he said no, just keep paying what I’m paying. Any ideas? Thanks.

I am a cosigner on 136,000 navient private loans. My daughter cannot afford to pay the $1400 mo they want. Neither can I. We are 2 mos past due. Lawyers I speak to say they can help. I own a home. Should I not make payments and let the lawyer handle this or should my daughter try dealing with navient herself first?

Rian, this is one of the most informative posts I’ve ever found on the internet – and I do a LOT on the i’net!

My original loan: $42K

Current Balance with accrued interest: $66K.

Just yesterday Navient called to say my account was in default. I had been making regular payments of $500/month with auto-deduction on my ATM card – but the card was replaced last month and I neglected to update the new number with Navient. I had previously missed 6 month’s last year, so they said this latest missed payment threw it into default and so now they offer 2 options:

1. Pay all of the $5K missed payments and they’ll lower my interest rate to .01% (from 5%) and continue to make monthly payments for the full amount ($66K).

2. Pay $40K now and be done – tho’ the kind lady said if I can’t come up with that, then I should suggest what I CAN pay now – implying that they’ll settle for even less.

I don’t have either of those amounts now. What I’d like to do is #1, but without paying the $5k now. And now that I know they’ll accept a lesser lump sum to settle, let it default again in some future year when hopefully I have the cash, and negotiate an even lower settlement then.

Any thoughts?

Thanks again for all the great details and mind-clearing suggestions you spelled out – and for continuing to host this very helpful blog!

… oh and by the way – she called y’day (Fri. Oct 16 and said naivent needs a clear answer on monday!

Rian, were any of your loans pre-2006? What was the breakdown, if any, between private loans and federal loans (FFEL or Direct) and pre- and post-2006?

All of my Sallie Mae loans were pre-2006.

This seems weird to me. 0.01% interest is usually the amount offered once you’re in default. Are you actually dealing with Sallie Mae/Navient, or are you dealing with someone working on their behalf like I was? As far as I know, they don’t offer settlements directly. They usually do it through a debt collector proxy.

Again, this sounds like you’re dealing with a debt collector working on their behalf.

I would suggest option 3: offer a settlement of $20K to be paid off over 2 years. The length of time you have to come up with a settlment is itself negotiable. Chances are, they will ask for a sizeable down payment up front, though. Like $5K or so. Is that something you can borrow, or have in the bank?

The offer won’t go away if you don’t have an answer by Monday. It’s just part of the mind games. That said, if you can have a clear course of action, then there’s less waiting, less stress, etc. I would offer my option 3 above, and see what they counter with.

You don’t need a lawyer (who will cost money) to come up with a settlement plan with Sallie Mae/Navient or one of their proxies. I don’t see what lawyers will offer in this case that you can’t get on your own. Like I told a previous commenter just above, make an offer to settle for like half the balance, payable over some number of years, and see what they counter with. If that falls apart, then you can always go the lawyer route.

Unfortunately the bookkeeping by a lot of these debt collectors is really, really bad: they calculate what you owe by taking the original balance, looking at the notes to see what was worked out, and then counting up the payment transactions they can find. If you make settlement for $X to be paid off by Y date, you can get screwed because Rep A that made the deal with you leaves, and Rep B can’t decipher A’s notes. It’s really terrible.

In your case, I would make a reasonable settlement offer, because I’d be shocked if you were even treading water at $10/mo — interest is still probably growing. Don’t sweat the $200, as annoying as it might be. Just get him/her to make you an offer, and have the cash ready to close the transaction immediately. $5K or $5.2K — at the end of the year, what difference does it make compared to having that monkey off your back?

I don’t know what he meant by “taken out of your tax refund”. That’s not true, unless your wages are being garnished. That said, settled debt (like your $43K that was written off) is taxed as income. So if you made $50K this year, you’re going to have to pay taxes as though you made $93K because that forgiven debt is treated as income by the tax code.

Rian: If all of your loans were pre-2006, then it sounds like the collection agency was eager to settle with you on account of the liability associated with that loan cohort. Sallie Mae has been hit with class action lawsuits for pre-2006 private loans, on account of charging late fees (or “supplemental fees”) calculated as a percentage of the installment (e.g., 5%). See Ubaldi v. SLM Corp. (U.S. District Court for the Northern District of California) (http://www.classaction.org/media/files/ubaldi,%20tac.pdf). They’ve been trying to fend these things off through settlements and through arbitration clauses.

I offered your #3, above. Refused.

We worked it out to pay the $5K to bring the payments current: 3K today, and 2K within 30 days.

Then the interest rate will be 0.01% and I’ll pay $409/month for like 13 yrs.

At the same time, we worked out a settlement offer she’s to seek approval for:

I pay half of the current balance ($66.6K/2 =33.3K) to settle it. I pay half of $13.3K for each of the next 2 months: $6,650 by Oct. 30 and the same amount by Nov. 30.

Then the remaining $20K gets spread over 48 months; $416/month. No interest.

I had some documented reasons why this shouldn’t have reached the default stage – well, they say that the fact it’s now in default is the only way these offers could have been on the table. Otherwise I would have kept paying $424/month with most of that going to interest (at 4.7%) = MANY more years!

By the way, she’s employed by Navient – but not in collections. She was adamant that her offers could not be offered by the Collections dept. She’s in a dept. called “Recovery” which is the last step before Collections.

Rian, I’ll be curious to hear your opinion. If there’s something I’m missing here. At the end of my call with the lady, she said she was confident the settlement offer would get approval. It’s better than the $40K they offered last week, and it’s spread over 4 yrs.

But her confidence makes me think, I wish she was going away with a proposal that had no chance – other than to elicit a counter offer.

I guess I could say after careful review I can only come up with $5K now (not 13.3)….

Hi Rian, thank you for answering me! Just so I understand, On November 11 I’ll be 3 mos behind. Should I call navient now? Up until now I’ve been avoiding them. Should I wait longer? Do I have to disclose my tax return or salary? Or just make an offer and if they don’t take it or I can’t afford their counter then just wait longer or go lawyer route another time? Ive got about $5000 I could give them now if I had to I could scrape it up. Thank you again!

I don’t know how this site works but I’m the Linda above who is the cosigner of the $136000 in navient private loans 3 mos behind Nov 11 etc…..

Great discussion! My original loan amount (w/Navient) was $42,000 with interest it’s grown to $73,000. I have 7 loans, 2 of which are at 15% interest rate. I Called and told them I no longer could afford the $883 monthly payment but wanted to negotiate on 4 of the loans. The combined balance on the 4 loans came in at $35,000, I was fortunate enough to have family that gave me $30,000. So I offered that to take care of those 4 loans and to get a reduced payment on the remaining 3 loans. They refused to work with me on the settlement. In fact the supervisor I spoke with raised his voice close to a scream and said I wasn’t listening and that would never happen. And that he was tired of discussing it with me and he had bent over backwards to help, which he had not. I started to get frustrated at this point. I then canceled all future payments and said I had no choice but to allow these to default. I know you’ve discussed but do you feel I should allow these to default and hope for a settlement? I feel I can get to the $40,000 range in a year for a settlement. My fear however is that they will continue to accrue interest and close in on $85,000 or more and I will not receive a settlement offer significantly lower than the current balance of $73k. It’s to the point it really does control your life. I have a cosigner on 2 of the loans which have a combined balance of $13,000. I’m at the point I refuse to give in now since they wouldn’t budge when I was offering the most I could offer to work with them. I really don’t know exactly what I’m looking for just some sort of guidance as how to proceed in my dealings with them/situation. I understand every situation is different. The $883 a month is half of my net income a month and I literally can’t survive on what’s left.

Thanks for any help

One last question is there anyway to negotiate what they report to credit bureaus about settling or is that just a foregone conclusion and no hope to save credit?

(Assuming these are private loans.)

Treating you like garbage is just part of the negotiation game, and I can pretty much guarantee you it’s rehearsed. So try not to take it personally. As they say in The Wire, “It’s all in the game, yo.”

In my experience, defaulting on your loans is a good way to maneuver for a settlement, regardless of what the idiot you spoke to said. Sallie Mae/Navient is a giant, faceless beauracracy, and most of the time this works against you, but it does have its upsides. In this case, the silver lining is that your loan will be moved from one group of service people (that contained your particular rep) whose metrics are based on extracting payments, to another group whose incentives will resemble something like “resolving delinquent loans via any means necessary”, where “resolution” means settlement, full payment, etc. Quite often settlement. This group of employees will literally be measured using different metrics as part of their performance review.. It’s sort of like if you called Comcast to cancel: the person you’re speaking to will be empowered to do things other groups are not.

I think if I were in your shoes, I’d take that $30K, and that $3-400/month that you can spare, and start putting it away for a settlement. Let them approach you first–and they will–and then offer them $20K and see what they counter with.

This is, like, the last thing you should worry about. Bad credit for a few years is a small price to pay for reclaiming your life.

1) You shouldn’t be borrowing any more money, so having shitty credit will keep you from doing that

2) You need to survive, and having good credit is much higher up on Maslow’s pyramid than where you are

To answer your question, though, they will report it as “Settled for less than the full balance”, and I’ve never heard of anyone negotiating that away outside of a courtroom.

Thanks for posting this. I’m not sure if it will help in my situation but I hope so. 26 yrs ago I took out my first student loan. I continued in school part-time and cared for my children. The last loan was 16 yrs ago but I’ve never been in re-payment, always deferment or forbearance. I believe I borrowed about 20k but now with interest I owe 91K. I have a special needs child(Autism & Down syndrome) I care for full-time now and I have health issues that hinder my ability to work. I was denied SS. I get ssi for my son. I’m lost as to what to do. We have nothing. I don’t own a car, house, or anything. My credit score is 300 and something because of my student loan. They call me all the time. I can’t even get a junk car let alone pay them 90k. Last year I earned 20k. Any ideas on what to do in my situation would be appreciated. I was hoping bankruptcy in my case. I have .15 in the bank! HELP!

I am still in school. I was paying the deferred loan payment to Sallie Mae of $25 per month. I filed bankrupt on my credit card debt of over $70,000 which we lived on when my husband was laid off for 2 years and also while I was going through school. When I filed bankrupt Sallie Mae said that voided out agreement and they will no longer accept the payment terms that I had set up. I owe them about $13,000 in total right now. This just started a couple months ago but they want me to give them like $8,000 to settle which I do not have any extra money. I have nothing in savings, I am just starting out in my career and have 2 kids, a house, etc. They are threatening to sell the loan, they keep telling me that I should make some arrangements with them because they are better to deal with than the people that I will talk to once they get rid of my loan. I don’t get why I still owe them anything if I listed them on my bankruptcy and they are a private loan. Since I am still in school the loan should be in default if they follow the same guidelines as the fed loans. I don’t know what is going on but I am frustrated. Do I even owe them?

Honest and serious answer: change your phone number, never contact them again, and forget about your loans. You make so little that even if they were federal loans, your wages wouldn’t be garnished, and you have more important things in your life than this anchor hanging around your neck. Put that weight down, and don’t pick it up again.

Zero contact protocol. Seriously, change your phone number. Create some space in your head if you can, so you can begin building a future for yourself and your kids as best you can. Nothing good will come of answering the phone.

I don’t see why settling your other debt in bankruptcy would affect an arrangement you had with a lender whose debt was not part of the bankruptcy settlement. That seems weird to me, but I’m not a lawyer or bankruptcy expert, and certainly not an expert in your case. I’m not sure that it matters. More on that below.

You can counter-offer if you want. Or not. I probably wouldn’t yet. I think you need to figure out what the real status of your bankruptcy arrangement is/was. See below.

Ah, the old “we’ll sell the loan!” bogeyman. Let them sell the loan. It changes nothing, and in fact may put you in a stronger negotiating position (which is why they’re employing these scare tactics). Whoever they sell it to will have different incentives than the group you’re dealing with now. Have a look at my reply to Jeff a little ways up where I go into a little more detail about how incentives affect collection agent behavior.

I don’t know. I think this is a question for an attorney — whomever helped you out with your bankruptcy. See what the terms of the bankruptcy were before you have another conversation with Sallie Mae/Navient. All of this may be a moot point, you may be done, and Sallie Mae/Navient’s beauracracy simply hasn’t caught up. (Or your paperwork fell through the cracks.)

Hi Rian, my first payment of $1400 was due August 11. I tried to get a payment I could afford before I was late but they wouldn’t work with me. They wanted my cosigner to call which she won’t. I haven’t called since. They are now calling both of us every day multiple times a day. Question: do I call now and try to work out payments I can afford? Wait longer? If so how long? My cosigner owns a home. Thank you for helping all of us.

(Assuming these are private loans.)

I would change my number, and get my life together, whatever that needs to be. (Get a job, get a better job, get healthy, etc.) Worry about the payments when you have your feet under you. I wouldn’t have any conversations with them until then.

Alternatively, you could block their number(s).

Hi Rian – Aren’t private student loans non-negotiable promissory notes and subject to debt Statute of Limitations? In my state 4 years (6 if negotiable); therefore, if one has made it well passed the SOL, isn’t the Lender out of luck on collecting, and the SOL could be used in court to have a lawsuit thrown out? Or am I missing something?

This thread was extremely helpful. I’m wondering though, what type of loan you had originally taken out. I have been getting screwed by Sallie Mae/Navient since I was still in college. I was supposed to be grandfathered into a loan that they didn’t offer the following year etc. All that aside I have found myself in severe trouble with the loan company and I’m not sure what to do. They want money I can not give them and they are telling me if I don’t agree to the monthly payment of that amount, they will take me to court. Any advice??